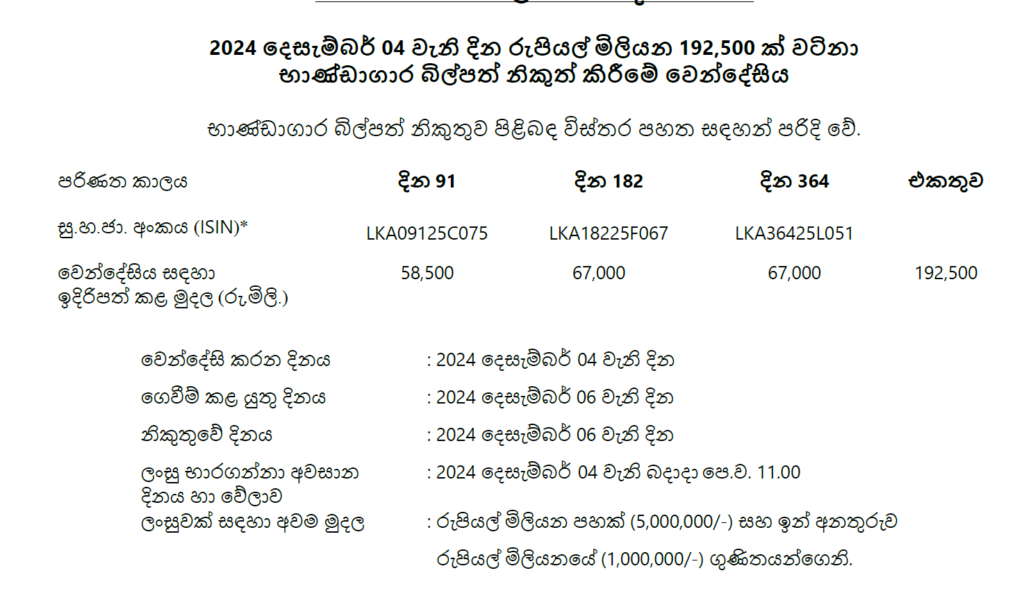

The Central Bank of Sri Lanka (CBSL) is set to raise Rs. 192 billion through an auction of Treasury Bills scheduled for December 4, 2024. This move is part of the government’s strategy to manage public debt and finance critical expenditures, including infrastructure development, social services, and debt servicing.

The auction will offer three tenures of Treasury Bills:

- 91-day bills

- 182-day bills

- 364-day bills

Bids for the Treasury Bills will be invited from primary dealers in government securities, who act as intermediaries between the Central Bank and institutional as well as retail investors. These dealers include licensed banks, investment firms, and other financial institutions authorized by the CBSL.

Submission Process:

Bids must be submitted exclusively through the electronic bidding system provided by the CBSL, ensuring a secure and efficient process. The electronic system is designed to maintain transparency and streamline the submission and evaluation of bids.

Minimum Bid Requirements:

Investors can place bids through the primary dealers, with each bid required to meet the minimum bid amount set by the Central Bank. This ensures the participation of institutional and qualified retail investors, contributing to a balanced and competitive auction environment.

The outcome of the auction, including the accepted yield rates and the total amount raised, will be announced shortly after the bidding closes. The Central Bank uses these auctions as a key tool to manage liquidity in the financial system and to align short-term interest rates with monetary policy goals.

Market analysts are closely watching this auction as it comes amid ongoing economic recovery efforts and discussions on Sri Lanka’s fiscal management strategies. The success of the auction will be a significant indicator of investor confidence in the country’s financial stability.