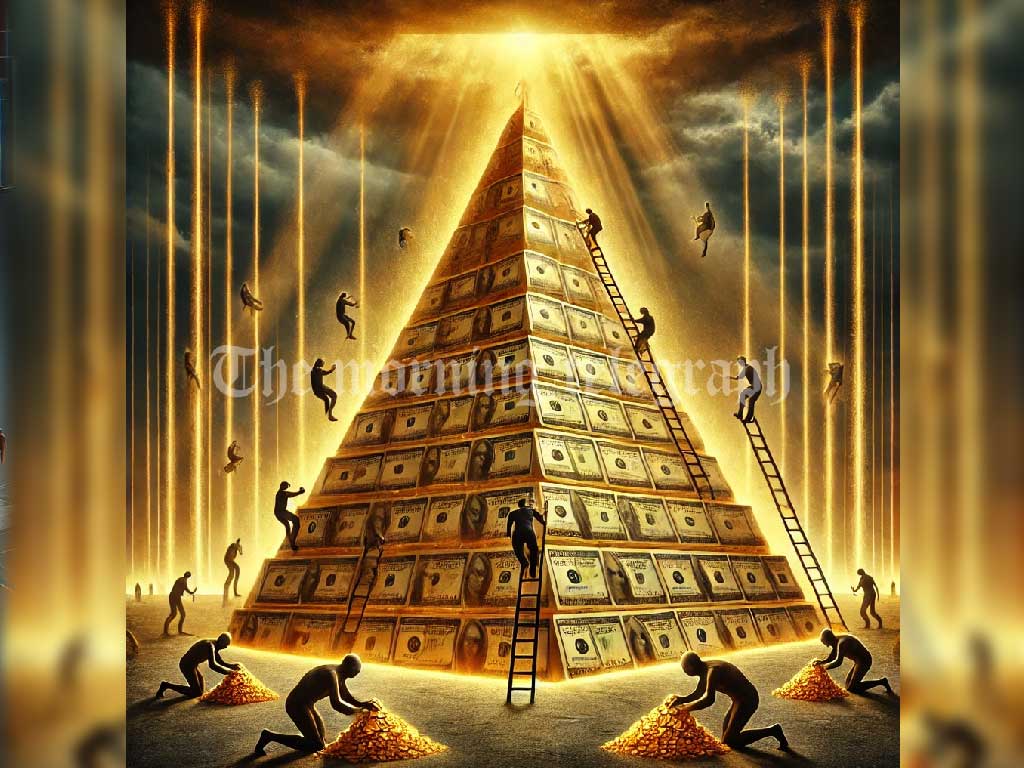

The Central Bank of Sri Lanka (CBSL) has issued a strong warning to the public about 20 entities accused of violating the provisions of the Banking Act, emphasizing the growing threat posed by pyramid schemes to the country’s financial stability.

The CBSL has been actively working with law enforcement authorities to file charges against individuals and organizations that contravene Section 83C(1) of the Banking Act. These efforts aim to safeguard the public from fraudulent financial activities and ensure the integrity of the financial system.

Since 2011, the Central Bank has initiated investigations and legal action against several institutions under Section 83C(3) of the Banking Act. These investigations seek to determine whether entities have violated or attempted to violate financial regulations.

The CBSL revealed the following 20 organizations as entities of concern:

- Tiens Lanka Health Care (Pvt) Ltd

- Best Life International (Pvt) Ltd

- Mark-Wo International (Pvt) Ltd

- V ML International (Pvt) Ltd

- Fast3Cycle International (Pvt) Ltd

- Sport Chain App, Sport Chain ZS Society Sri Lanka

- Onmax DT

- MTFE App, MTFE SL Group, MTFE Success Lanka, MTFE DSCC Group

- Fastwin (Pvt) Ltd

- Fruugo Online App/Fruugo Online (Pvt) Ltd

- Ride to Three Freedom (Pvt) Ltd

- Qnet

- Era Miracle (Pvt) Ltd and Genesis Business School

- Ledger Block

- Isimaga International (Pvt) Ltd

- Beecoin App and Sunbird Foundation

- Windex Trading

- The Enrich Life (Pvt) Ltd

- Smart Win Entrepreneur (Pvt) Ltd

- Net Fore International (Pvt) Ltd | Netrrix

The CBSL reiterated the importance of public vigilance, warning against participation in such schemes that often promise unrealistic returns but lead to financial loss for investors.

Legal action has been taken against several of these organizations, and investigations into others are ongoing. The CBSL urges the public to report suspicious financial activities and verify the legitimacy of financial institutions before making investments.

By raising awareness, the Central Bank aims to reduce the impact of fraudulent schemes and maintain trust in Sri Lanka’s financial sector.