Dr. Nandalal Weerasinghe, Governor of the Central Bank of Sri Lanka, highlighted a significant communication gap regarding major economic decisions, noting that the general public, particularly Sinhala and Tamil speakers, are often unaware of crucial economic developments. Speaking at a meeting with newspaper editors, Dr. Weerasinghe pointed out that while English-speaking audiences are adequately informed, decisions impacting the country’s economy are not effectively reaching the majority of the population.

Acknowledging the concern raised by a newspaper editor about the need for more accessible communication, Dr. Weerasinghe agreed that the Central Bank needs a dedicated spokesperson or media liaison, available around the clock, to ensure timely and clear dissemination of information to the public.

In an effort to improve communication, the Central Bank is revamping its website to be more user-friendly and is exploring new channels such as WhatsApp groups to enhance media access and increase the reach of its messages. Additionally, quarterly workshops with online access for the media are being organized to foster better understanding and transparency.

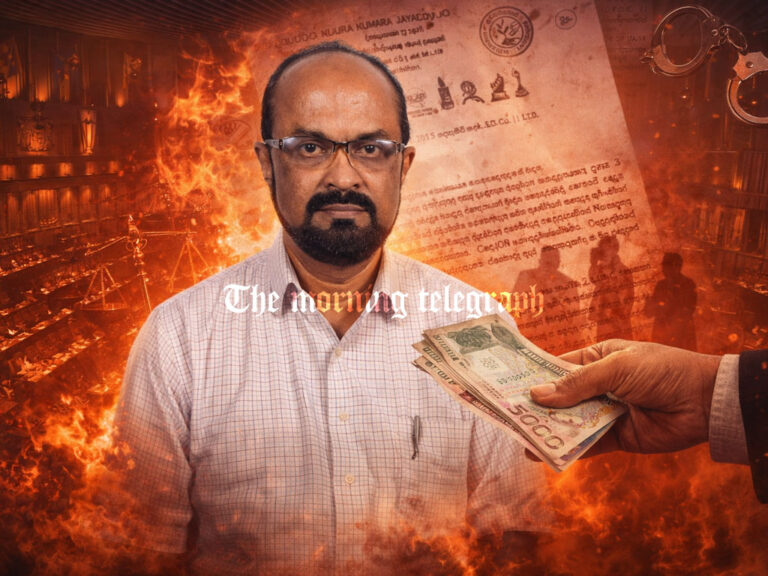

On the topic of financial fraud, Dr. Weerasinghe stressed that many Sri Lankans continue to fall victim to various scams, including pyramid schemes and newer frauds, such as those occurring on WhatsApp. He reiterated his advice to the public to stay vigilant, particularly when it comes to sharing sensitive information such as passwords and one-time passwords (OTPs).

Regarding the foreign debt restructuring process, the Governor revealed that while agreements for new loan terms are still pending, much progress has been made, and the process is expected to be finalized by the first half of 2025. He reassured the public that Sri Lanka’s Central Bank has sufficient foreign reserves to meet the country’s obligations. He also noted that the importation of vehicles will be allowed in three phases.

Dr. Weerasinghe provided an optimistic outlook on the country’s economy, forecasting a GDP growth of 5 percent for the year and indicating that government revenue collection would meet its annual target for the first time. He also touched on the issue of low deposit interest rates, explaining that in some countries, savers accept rates as low as 2 percent and do not rely on interest income for daily needs.

On the subject of the Central Bank’s independence, Dr. Weerasinghe emphasized that this year marked a significant achievement in maintaining the institution’s autonomy, with no government representatives on the governing board and no fiscal dominance over monetary policy. He also noted that accountability has improved significantly under this new framework.