The first meeting of the Ministerial Consultative Committee on Finance, Planning, and Economic Development for the 10th Parliament was held under the patronage of the Minister of Labour and Deputy Minister of Economic Development, Dr. Anil Jayantha, along with the Deputy Minister of Finance and Planning, Dr. Harshana Suriyapperuma.

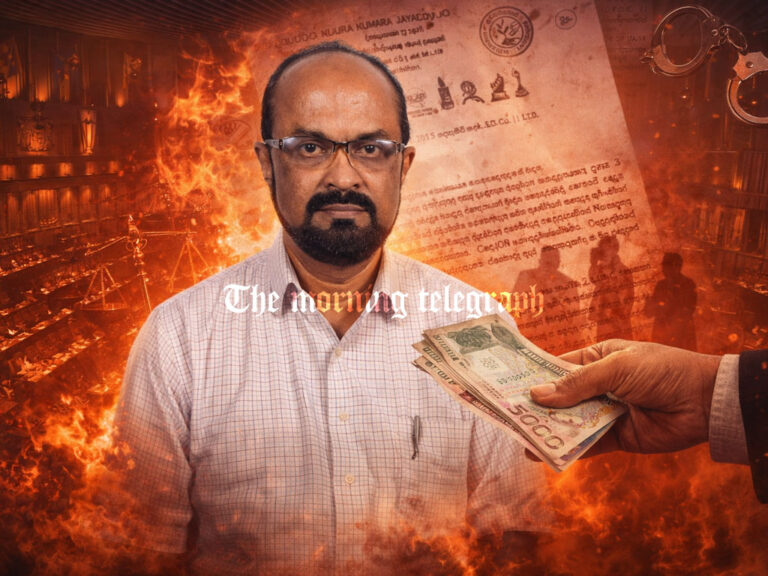

During the meeting, Members of Parliament inquired about the release of 323 containers by Sri Lanka Customs during the recent container congestion. They pointed out that certain parties are politically accusing the government of orchestrating this release, suggesting that a clear explanation should be provided by officials.

The Director General of Customs, addressing the matter, stated that containers have been released in this manner on four previous occasions as a technical measure to resolve congestion. He further explained that the Ministry of Finance has appointed a committee headed by a Deputy Secretary to the Treasury to investigate the matter and report accordingly.

Members of the committee emphasized that false information circulating about the incident is causing inconvenience to the government. Therefore, the situation needs to be clarified comprehensively.

Additionally, the committee members highlighted issues related to data collection by the Social Welfare Benefits Board for providing relief benefits. The Chairman of the Social Welfare Benefits Board noted that due to the reluctance of state officials to collect data, various individuals were involved, resulting in discrepancies in data collection. He mentioned that nearly 800,000 applications have been received, and the census process has been completed for approximately 700,000 of them. He assured the committee that previous shortcomings would be corrected, and the work would be completed by July.

The members stressed the importance of ensuring that eligible beneficiaries are not excluded during the census. They also suggested providing a mechanism for making minor updates, such as changes to beneficiaries’ bank accounts, through the Divisional Secretariats.

Furthermore, concerns were raised regarding the provision of the elderly allowance to welfare scheme beneficiaries. In some cases, the allowance is credited to the bank account of a family member rather than directly to the beneficiary. A request was made to allow recipients to receive the payment through post offices. The Chairman of the Welfare Benefits Board responded that he intends to discuss the matter with the Ministry to arrive at a more practical solution.

The MPs also questioned the imposition of a 15% service export tax introduced through an amendment to the Inland Revenue Act. The Deputy Ministers of Finance explained that the measure was implemented with a maximum limit of 15% based on the principle of fairness. They clarified that the tax is levied only on profits, not on total income, and that measures are in place to prevent double taxation when taxes are paid in one country.

They further noted that while other individuals pay income tax at a maximum rate of 36%, the service export tax is capped at 15%. The original proposal of 30% was reduced by half to 15% to ensure social justice without causing prejudice to anyone.

Attention was also drawn to the current status of the 2024 Population and Housing Census. Officials from the Department of Census and Statistics reported that 40,000 officers have been deployed after proper training, and the process is in its final stages. The members underscored the necessity of accurate data collection since policy decisions are made based on reliable data.

Officials also informed the committee that a new Population and Housing Act has been drafted to replace outdated laws, with the aim of establishing a more reliable data collection system in the future.