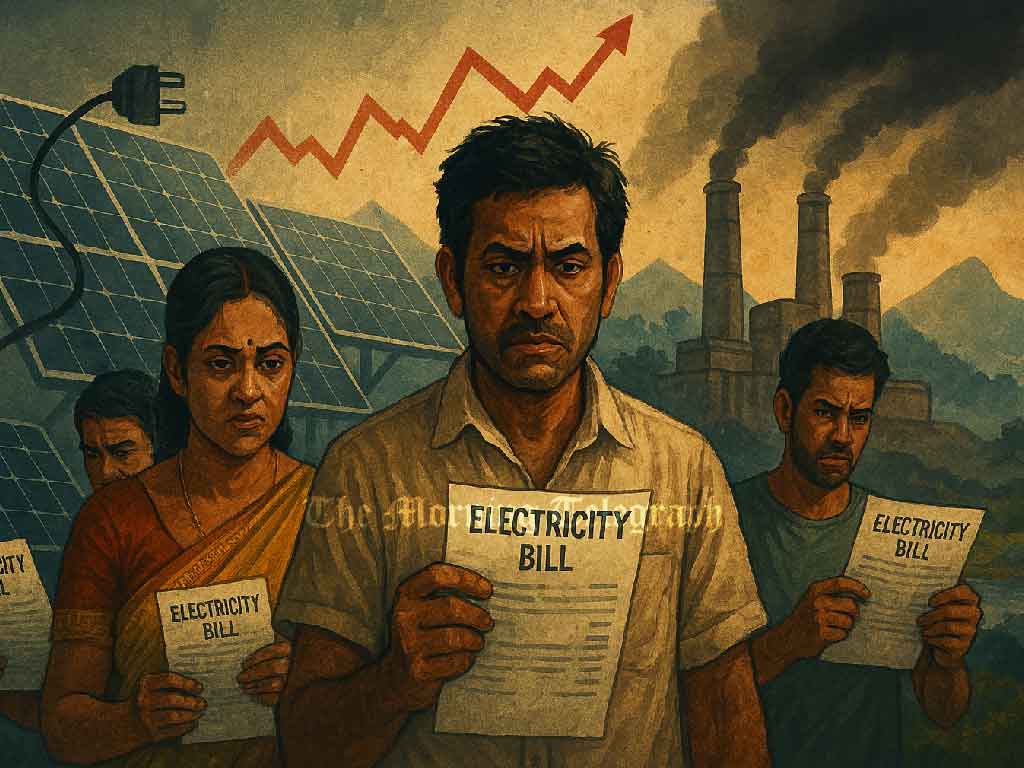

A looming electricity tariff hike has stirred alarm across the country, with the Electricity Users’ Association claiming that a 40% increase in electricity bills may be on the horizon. According to the association, the recent disruption of solar power production—particularly from rooftop installations—has not only caused significant financial damage to entrepreneurs and the state but is also paving the way for what they suspect to be a deliberate rate revision strategy.

Sanjeewa Dhammika, the National Secretary of the Electricity Users’ Association, expressed these concerns in a public statement, asserting that the solar power industry has suffered losses amounting to Rs. 550 million due to the curtailment. Additionally, he estimates that the government has lost approximately Rs. 1,100 million in revenue.

He pointed out that around 790,000 units of low-cost solar electricity were lost to the national grid during this period. As a result, the energy shortfall is now being compensated for by activating thermal power plants, which rely heavily on fuel. “This switch from clean, affordable solar energy to fuel-based electricity is wasteful,” Dhammika noted. “Power that could have been bought at Rs. 10 per unit is now being generated at costs ranging from Rs. 50 to Rs. 100.”

When all losses are calculated—including fuel costs, lost solar contributions, and economic impact—the total damage caused by the solar disruption amounts to approximately Rs. 2.1 billion, he said.

The association has also called on the Public Utilities Commission of Sri Lanka (PUCSL) to intervene and act in the interest of electricity consumers, describing it as a moment for the regulatory body to “stand up for innocent people.”

Dhammika warned that this disruption appears to be a precursor to a significant tariff hike scheduled for June, with officials likely to justify the increase by citing high production costs. He likened the unfolding situation to a carefully staged procession—warning that the nation must stay alert as the electricity sector appears poised for a major policy shift.