While ordinary Sri Lankans struggle under high income taxes, new revelations show Members of Parliament paying a fraction of what’s expected. A viral salary slip raises serious questions about systemic privilege, tax loopholes, and hidden perks in Parliament.

The disparity in income tax payments between Sri Lanka’s Members of Parliament and ordinary citizens has sparked widespread outrage after recent revelations laid bare a troubling double standard.

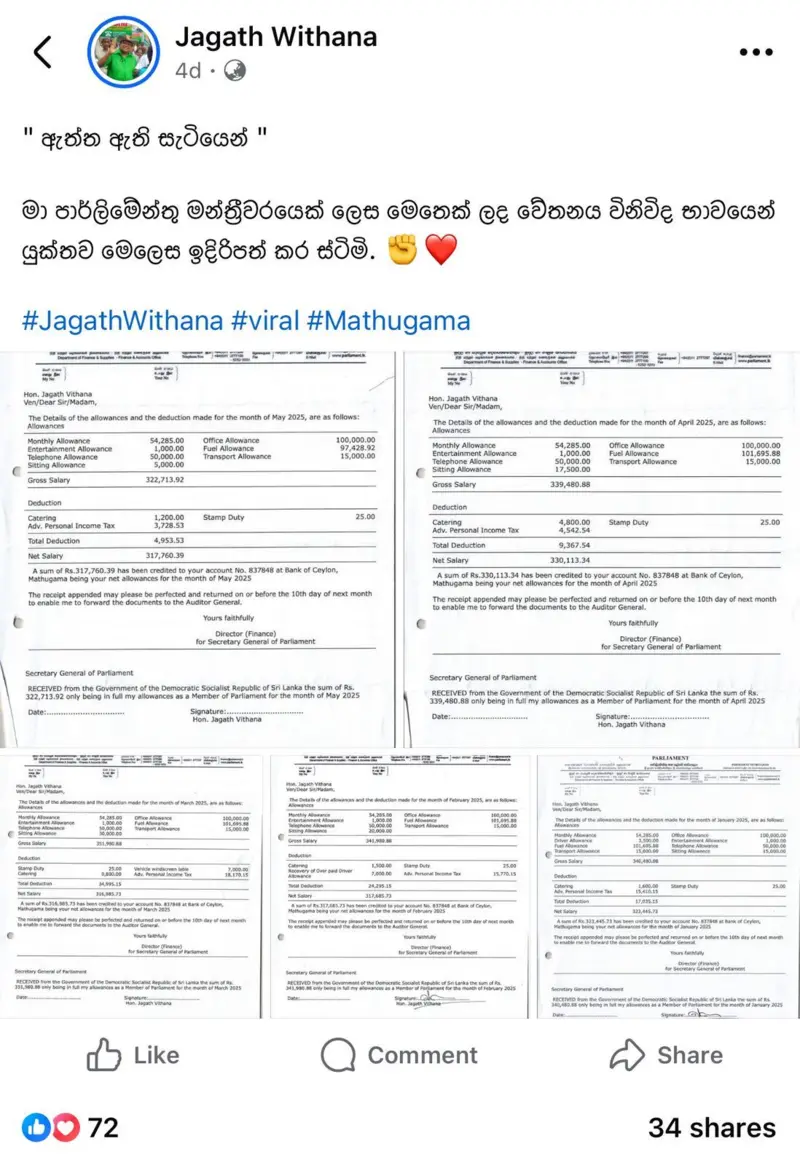

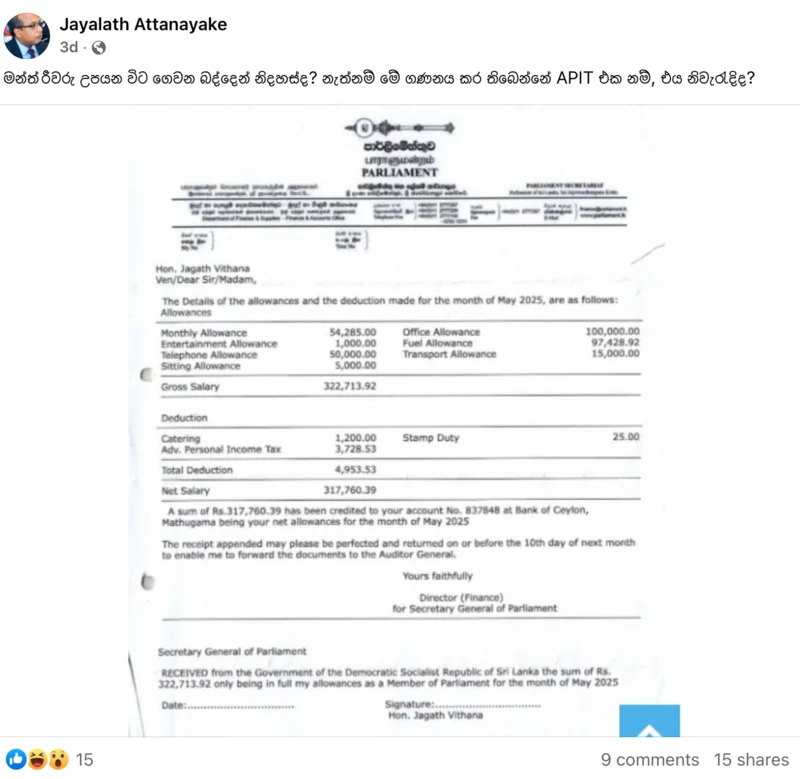

The controversy began when Jagath Withana, a Samagi Jana Balawegaya (SJB) MP representing the Kalutara District, posted several of his monthly salary slips from January to May 2025 on Facebook. The post, titled simply “As it is,” included his official salary, allowances, and income tax deductions.

But what caught everyone’s eye wasn’t the MP’s income, it was the startlingly low amount of income tax deducted despite a substantial monthly salary.

A Salary Over Rs. 327,000; But Less Than Rs. 4,000 in Tax?

According to the May 2025 salary slip, MP Jagath Withana earned Rs. 327,713.92, but the income tax deducted that month was only Rs. 3,728.53. This figure triggered a wave of criticism and questions across social media and professional circles.

Under the country’s April 2024 tax revisions, an individual earning Rs. 300,000 per month is expected to pay at least Rs. 20,000 in Advance Personal Income Tax (APIT). Previously, this figure was even higher, approaching Rs. 36,000.

So how is it that a public official earning well above this threshold pays nearly 80% less than what’s mandated for the general public?

Tax Experts and Academics Weigh In: “This Doesn’t Add Up”

Tax analysts and university academics have expressed concern over what they view as a significant deviation from fair tax practices.

One such academic, a professor at a leading university in Sri Lanka, stated, “We’ve taught for years that taxable income includes salary and allowances unless explicitly exempt. But now, we’re seeing situations where an MP earning over Rs. 300,000 pays less than Rs. 4,000 in tax. That doesn’t align with the public tax code.”

He emphasized that under the current APIT system, any individual earning above Rs. 300,000 should see a minimum of Rs. 20,000 deducted in monthly income tax.

“Even accounting for some tax-free allowances, this deduction seems unusually low. Are these exemptions being over-applied or under-scrutinized? These are questions that demand answers,” he added.

Allowances: The Legal Loophole?

The central issue appears to revolve around how allowances, such as fuel, vehicle use, and telecommunications — are treated under current tax laws.

A senior official from the Inland Revenue Department, speaking off the record, confirmed that a government circular dated April 6, 2023, altered the way allowances are taxed. The directive allows only 25% of certain categories of allowances to be taxed. The remaining 75% is considered non-taxable.

“In this case, the MP has received over Rs. 200,000 in combined allowances for fuel, transportation, and communication. But only a quarter of that was considered taxable income,” the official explained.

This regulation applies to government employees, including MPs, and is also extended to private sector employees receiving similar allowances, according to the same circular.

Is the Law Ethical? A Growing Public Outcry

Although these tax breaks may be technically legal, many citizens are questioning their moral validity, especially during a time of economic strain, high inflation, and rising cost of living.

Public frustration stems not only from the seeming injustice of the system, but also from the lack of transparency around how these tax benefits are structured and applied.

“There’s a broader issue here,” noted a financial ethics lecturer. “While the public is expected to shoulder the country’s tax burden, our lawmakers are seemingly insulated from those same expectations.”

Shouldn’t All Income Be Taxed?

According to the Sri Lankan Income Tax Act, all income, including base salary, allowances, and additional benefits , should be declared and taxed unless explicitly exempted.

A key concern now is whether some MPs are under-declaring taxable earnings by over-categorizing income as allowance. If that’s the case, they may face hefty tax penalties when submitting end-of-year returns.

But unless there is proper enforcement and auditing, many fear this system may continue to benefit those in power while the average citizen bears the brunt.

Parliament’s Finance Division Silent

When inquiries were made to the Parliamentary Finance Division regarding the taxation of MP salaries, officials responded that such information is only accessible through the Right to Information (RTI) process.

A formal RTI application has since been submitted requesting disclosure of how MPs’ taxes are calculated and whether any special exemptions or deviations are being applied.

The outcome of that inquiry may shed further light on what many are calling a two-tier tax system, one for the public, and another for the political elite.

A Nation’s Frustration

This incident has fueled growing resentment among taxpayers who are already stretched thin. From small business owners to salaried professionals, the cry is the same: “We are paying more than our fair share while those in power pay the least.”

Calls are growing for a full audit of parliamentary remuneration, a review of exemptions and deductions, and a more transparent and enforceable tax structure for all public officials.

While technicalities in tax law may justify some of the deductions, the real issue remains one of public trust. If lawmakers cannot lead by example, how can they expect citizens to comply?

So Who Really Pays?

As scrutiny intensifies and more salary slips begin to surface, the debate is no longer just about numbers, it’s about accountability, leadership, and whether the current system is serving the nation fairly.

Until comprehensive reform is undertaken, one haunting question remains:

If MPs don’t pay their fair share, why should anyone else?