Donald Trump’s plan to slap a 100% tax on imported computer chips is set to shock the global economy. From iPhones to electric cars, the price of digital products could skyrocket as the former US president forces tech giants to manufacture in America.

US President Donald Trump has stunned the global tech world by announcing a bold new policy: a 100% tariff on imported computer chips and semiconductors. The move is expected to shake up supply chains, escalate costs, and send prices of electronics, home appliances, and vehicles soaring across the globe.

Critics are warning that this drastic tariff could unleash a wave of price hikes on everything from smartphones to electric cars, dealing a major blow to consumers and manufacturers alike.

Trump unveiled the plan during a high-profile meeting with Apple CEO Tim Cook at the White House. “We’re going to impose a tariff of roughly 100% on computer chips and semiconductors,” he said. “But if you manufacture your products in the United States, there will be no tax.”

The former president’s strategy appears to be aimed at forcing American tech companies to move production facilities back to U.S. soil. During the COVID-19 pandemic, a global shortage of semiconductors exposed deep vulnerabilities in international supply chains and significantly contributed to the rising cost of vehicles and electronics. That crisis, Trump argues, justifies a strong push for domestic manufacturing.

Apple, whose supply chain is heavily reliant on China, has reportedly agreed to invest an additional $100 billion in American manufacturing over the next four years. This brings its total planned US investment to $600 billion. Currently, nearly 90% of iPhones are assembled in China, a dependency Trump has long criticized.

Despite the sweeping nature of the tax, there are exemptions that may cushion the blow for certain players. Taiwan Semiconductor Manufacturing Company (TSMC), Samsung Electronics, SK Hynix, and US-based Nvidia will not be subject to the 100% tariff, as they either have production within the US or meet exemption criteria. These companies are among the world’s largest chip manufacturers and stand to benefit competitively from the policy shift.

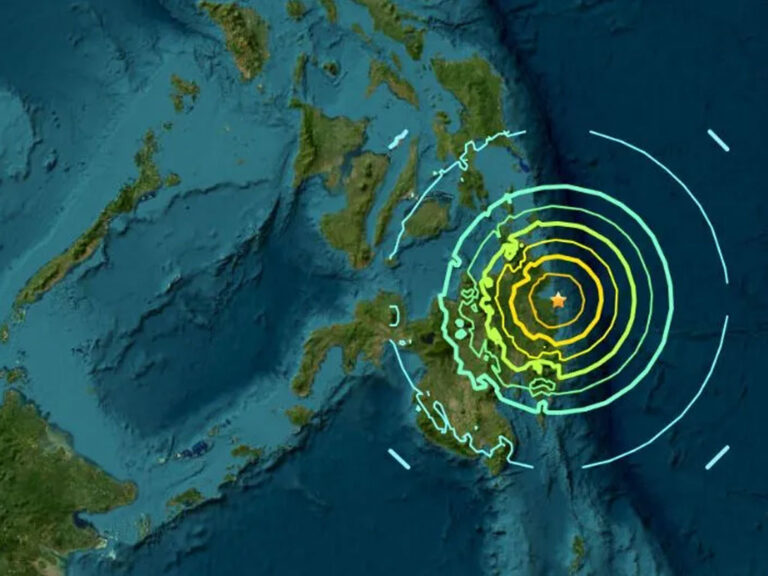

But for many developing nations, especially those in Asia, the news is bleak. Dan Lachica, president of the Philippine Semiconductor Industry Association, said the policy could be “devastating” for the Philippines. With semiconductors accounting for around 70% of the nation’s exports, the new tariff may cripple one of its biggest industries.

According to the World Semiconductor Trade Statistics Institute, global demand for computer chips continues to grow, with sales rising 19.6% through June of last year. This momentum is likely to face disruption if the tariff is implemented, creating turbulence in both consumer markets and the tech industry.

Trump’s approach starkly contrasts with the Biden administration’s CHIPS and Science Act, which invested over $50 billion in chip factories, R&D, and worker training in the US. While Biden used tax incentives to attract private investment, Trump’s plan relies on punitive tariffs to achieve similar goals, using economic pressure rather than financial support.

The new 100% import tax on semiconductors is set to be officially announced next week. Industry insiders say the impact will be far-reaching and immediate, affecting countries across Asia, Europe, and the Americas. With digital products at the core of modern life, the ripple effects of Trump’s tariff may be felt in households around the world.