Under the authority granted by Sections 19 (1) and 19 (2) of the Financial Transactions Reporting Act No. 6 of 2006, administrative penalties have been imposed on institutions that failed to comply with the provisions of the Act.

These penalties have been determined based on the nature and severity of the identified non-compliance.

Accordingly, the Sri Lanka Financial Intelligence Unit, the primary regulatory body responsible for preventing money laundering and combating the financing of terrorism, has collected a total of Rs. 6,500,000.00 in fines from reporting institutions during the period from January to June 2025. This sum has been deposited into the Consolidated Fund, as outlined below.

1. National Savings Bank

- Date of Penalty Imposition: 16 April 2025

- Fine Amount: Rs. 3,500,000.00 (Three million and five hundred thousand rupees)

- Date of Payment: 02 May 2025

Reason for Penalty:

This fine was issued due to NSB’s failure to comply with the Financial Transactions Reporting Act No. 6 of 2006 and related regulations, including:

i. Failure to report multiple financial transactions and electronic funds transfers exceeding one million rupees or its equivalent in foreign currency to the Financial Intelligence Unit within the stipulated 31-day timeframe.

ii. Failure to maintain updated lists of individuals, groups, and entities designated under United Nations Resolution No. 1 of 2012 (UN Security Council Resolution 1373) and the 2017 UN Resolution concerning the Democratic People’s Republic of Korea (UN Security Council Resolution 1718).

iii. Failure to adhere to freeze orders issued by the Financial Intelligence Unit and upheld by the Western Province High Court in Colombo, as well as conducting debit transactions on accounts that had been deactivated.

iv. Despite these procedural weaknesses, on-site inspections did not uncover evidence of NSB engaging in business with persons or entities designated under the relevant United Nations Security Council Resolutions.

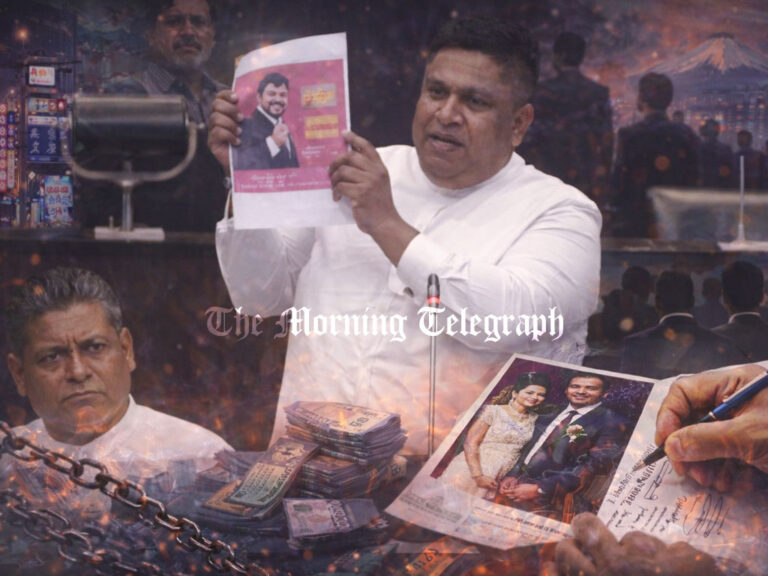

2. Balis Limited

- Fine Amount: Rs. 1,500,000.00 (One million and five hundred thousand rupees)

- Date of Payment: 29 April 2025

Reason for Penalty:

This casino was penalized for non-compliance with the Financial Transactions Reporting Act No. 6 of 2006 and associated regulations, including:

i. Failure to perform ongoing customer due diligence based on a risk-based framework to identify, evaluate, and manage risks of money laundering and terrorism financing.

ii. Failure to obtain identity documentation from customers initiating business relationships through online platforms.

iii. Failure to verify customer names against United Nations Security Council sanction lists at the time of account opening, and failure to conduct ongoing verification when such lists were updated.

iv. Failure to implement adequate systems for monitoring transactions and identifying suspicious activity.

v. Failure to maintain records used for customer identity verification, including correspondence and documentation collected through ongoing due diligence.

vi. Despite these issues, inspections did not find evidence that Balis Limited had conducted business with any individuals, groups, or entities listed under UN Security Council resolutions.

3. Bellagio Limited

- Fine Amount: Rs. 1,500,000.00 (One million and five hundred thousand rupees)

- Date of Payment: 29 April 2025

Reason for Penalty:

This entity, also operating in the casino sector, was penalized for:

i. Failing to carry out ongoing customer due diligence using a risk-based approach to detect and manage potential money laundering and terrorism financing risks.

ii. Failing to secure identity documents from customers who initiated business relationships through digital means.

iii. Failing to conduct mandatory name checks against UN-designated sanction lists when onboarding new customers and during subsequent list updates.

iv. Failing to establish internal procedures to monitor transactions and detect suspicious financial activities.

v. Despite these procedural deficiencies, inspections did not identify any current or past business relationships with designated individuals, groups, or entities as per the UN Security Council resolutions.

The Financial Intelligence Unit’s actions underscore the increasing regulatory pressure on both financial institutions and high-risk industries like casinos. As the global financial environment tightens its anti-money laundering and counter-terrorism financing measures, Sri Lanka’s enforcement efforts are being closely watched by international watchdogs.