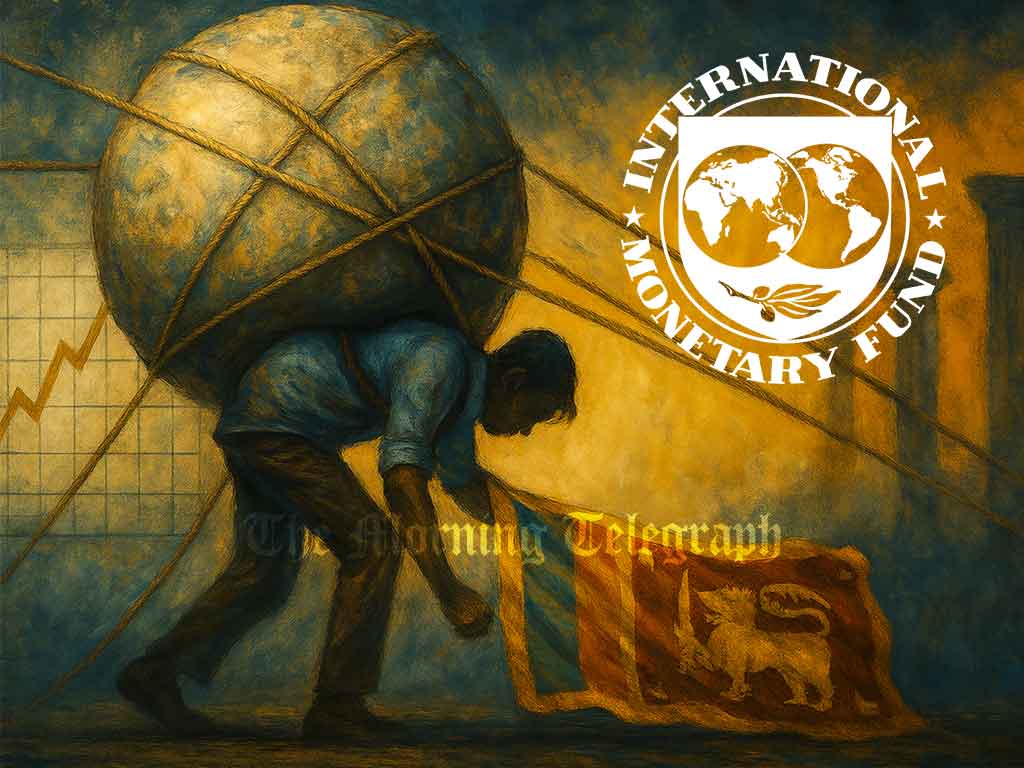

Sri Lanka’s debt restructuring may have lowered borrowing costs and restored market access, but the IMF warns the island is far from safe. A new paper reveals that only strict fiscal discipline, smarter debt management, and transparent borrowing can prevent the nation from slipping back into crisis.

Sri Lanka’s recent sovereign debt restructuring has brought short-term relief, but the International Monetary Fund (IMF) has sounded a sharp warning that the country’s fragile gains will evaporate without strict fiscal discipline and stronger public debt management. In its latest working paper, “Sri Lanka’s Sovereign Debt Restructuring: Lessons from Complex Processes,” IMF economists Peter Breuer, Sandesh Dhungana, and Mike Li outlined both the progress made and the serious challenges that still lie ahead.

The restructuring, concluded in late 2024, helped ease borrowing costs and restore investor access to financial markets. Treasury bill interest rates dropped to around 8.5 percent by March 2025, while the government shifted to issuing more long-term treasury bonds, a move the IMF hailed as critical to reducing refinancing risks and stabilizing gross financing needs. Domestic debt operations carried out in September 2023 gave the government breathing space, reignited private credit growth, and supported an economic recovery that had been stalled by years of crisis.

But the IMF was blunt: restructuring alone cannot secure debt sustainability. The report stressed that Sri Lanka now faces a complex post-restructuring debt portfolio that requires careful cost and risk analysis before signing new contracts, and better alignment of new borrowing with fiscal goals. “Continued prudent fiscal and macro policies and stronger institutions are essential and there is no room for slippage on the fiscal front,” the paper warned.

Sri Lanka’s debt collapse was fueled by years of lax fiscal policies, low tax collection, and costly international bond issuances in the 2010s, compounded by an overvalued exchange rate and external shocks. The Covid-19 pandemic pushed the economy over the edge, leading to the country’s first-ever default in April 2022. The subsequent IMF Extended Fund Facility programme aimed to restore debt sustainability through fiscal consolidation, external adjustments, and realistic macroeconomic planning.

The restructuring process itself was complicated. Creditors ranged from international bondholders to bilateral lenders like China and India, as well as domestic banks. With no existing forum to coordinate these diverse actors, Sri Lanka initially had to pursue a parallel approach before an official creditor platform was set up to share information. Negotiations were further delayed by disputes over transparency, comparability of treatment, and the use of state-contingent instruments.

Now, with domestic stability returning, the IMF says the focus must shift to protecting those fragile gains. Enacting the Public Finance Management Act and the Public Debt Management Act are seen as crucial steps in strengthening fiscal oversight and decision-making. The paper also called for a transparent public investment programme, strong procurement systems, and tighter monitoring of all new borrowing to avoid another debt spiral.

The IMF concluded that Sri Lanka’s experience holds lessons for other emerging economies: successful restructuring is not just about striking deals with creditors, but about ensuring financial and social stability at home, applying fairness across creditors, and using innovative instruments responsibly. For Sri Lanka, the message is clear. Without discipline and vigilance, the debt trap could snap shut once again.