A long standing loophole that allowed vehicle data manipulation is being shut down as Sri Lanka Customs launches a digital integration drive aimed at protecting state revenue and ending registration fraud.

Sri Lanka Customs has begun a significant technological reform of its vehicle clearance and registration process, targeting a long identified weakness that enabled the manipulation of motor vehicle data after import clearance. The initiative follows a detailed inquiry by the Committee on Public Accounts, which found that the absence of a secure computerised link between Sri Lanka Customs and the Department of Motor Traffic had created space for fraudulent alterations during vehicle registration.

According to Parliamentary Series No. 243, this disconnect allowed key vehicle details to be changed after Customs clearance. These included the year of manufacture, country of origin, engine capacity and other specifications that directly influence import duties and taxes. Because this data was not digitally locked between institutions, vehicles could be registered using information that did not match the original Customs declaration.

To address this vulnerability, authorities have introduced a new “digital firewall” based on “system-to-system integration” through the ASYCUDA World platform. This upgraded process formalises how information moves between agencies and removes manual intervention that previously allowed inconsistencies to go undetected.

Under the new framework, data entered in the “Vehicle Sheet” of the Customs Register is now transmitted electronically and directly to the Department of Motor Traffic. This includes engine numbers, chassis numbers, vehicle model details and the precise amount of Customs Import Tax paid. As a result, the information used for vehicle registration must exactly match the data approved by Customs, significantly reducing the scope for revenue leakage through tax fraud.

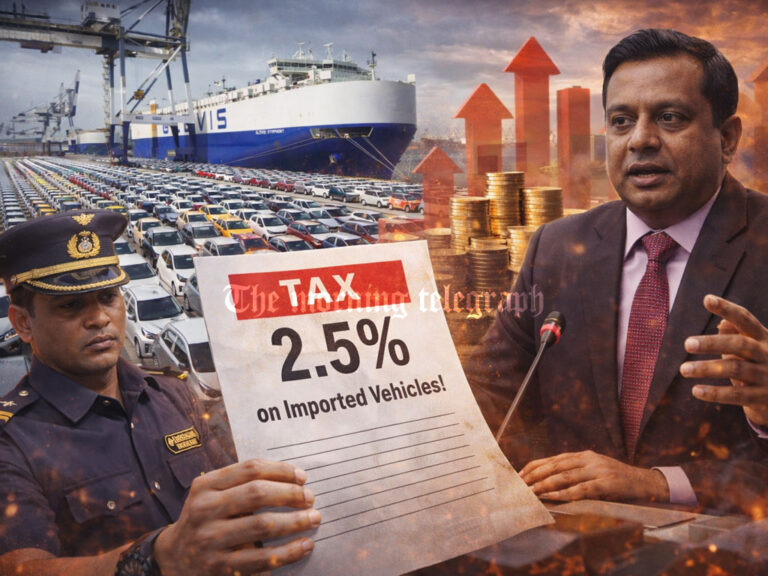

Historically, one of the most common forms of abuse involved misclassification of vehicles to fall within lower tax brackets. Even a small change in engine capacity can result in excise duty differences amounting to millions of rupees. In other cases, manufacturing years were altered to bypass age restrictions or misuse duty free permits. These practices deprived the treasury of substantial revenue over time.

To strengthen oversight, the Department of Motor Traffic has now been granted “view-only” access to the ASYCUDA World system. This allows officials to conduct real time verification of daily transmitted data against the original Customs declaration, ensuring transparency at the point of registration.

The financial impact of this reform is central to the government’s broader revenue protection strategy. The COPA report notes that the Ministry of Finance, Planning and Economic Development has prioritised tighter financial management within Sri Lanka Customs to ensure that all state revenue is collected without loss. The objective is to eliminate the “possibility of irregularities” that have historically weakened public finances.

As part of this effort, the Ministry now conducts quarterly Audit Management Committee meetings to provide oversight, guidance and accountability across the system.

While the reform marks a major step forward, the broader vision remains a “quad-agency” digital ecosystem. Sri Lanka Customs “indisputably admits the requirement” to electronically link four key institutions: Customs, the Department of Motor Traffic, the Department of Inland Revenue and the Department of Import and Export Control. At present, full integration is active mainly with the DMT.

Once completed, this shared data loop will allow every authority to track a vehicle’s entire fiscal history from import to registration and taxation. The modernisation initiative, formalised in a report submitted to Parliament on November 6, 2025, is viewed as a critical step toward transparent governance, stronger financial discipline and meeting ambitious national revenue targets.