Sri Lanka’s Central Bank Governor has sought to calm debt fears while signaling that cyclone related costs may require changes to IMF spending rules, even as confidence grows over the country’s ability to repay foreign loans by 2028.

Central Bank Governor Dr. Nandalal Weerasinghe has rejected what he described as unfounded fears that Sri Lanka will face an inability to repay its foreign debt in 2028. Speaking at a meeting with media heads, he stressed that the country’s foreign exchange reserves are projected to rise steadily over the next four years, reaching US $10 billion, which would allow Sri Lanka to meet its debt obligations without defaulting.

He explained that the current reserve position, which stands at around US $6.8 billion, will be strengthened through disciplined economic management, export growth, and continued financial reforms. On that basis, he said there is full confidence that debt repayment commitments can be honored on schedule.

However, the Governor acknowledged that the recent cyclone has imposed additional financial burdens on the government. Due to these unforeseen disaster related expenses, the spending limits agreed with the International Monetary Fund are expected to be renegotiated for the current year. He confirmed that the necessary parliamentary approval for this adjustment has already been obtained.

Addressing disaster relief, Dr. Weerasinghe said the government has already provided assistance to affected communities using tax revenues. He added that the state retains the capacity to allocate further funds if required, ensuring continued support for recovery and rehabilitation efforts.

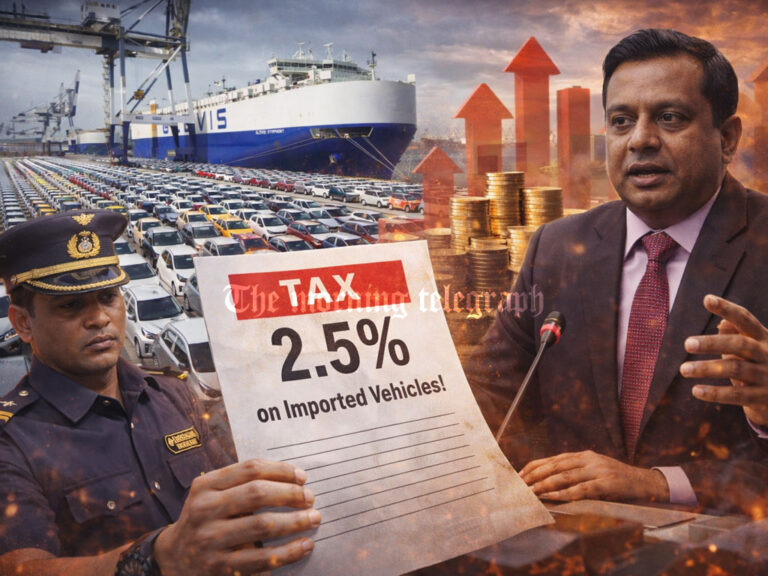

Despite ongoing economic pressures, he noted that Sri Lanka spent approximately US $1.5 billion on vehicle imports last year. He indicated that a similar level of expenditure is likely to occur this year as well, reflecting consumer demand and easing import restrictions.

The Central Bank Governor firmly dismissed suggestions to temporarily suspend loan repayments in response to the disaster. He warned that such a move could seriously damage Sri Lanka’s international credibility and discourage foreign investment at a time when external confidence remains critical for economic recovery.

Reiterating his stance, Dr. Weerasinghe emphasized that Sri Lanka’s debt sustainability strategy remains intact, supported by a gradual buildup of reserves and adherence to key IMF backed reforms.