A luxury car import has triggered scrutiny at Sri Lanka Customs after officials uncovered a model mismatch, leading to a hefty penalty and renewed debate over high-end vehicle declarations.

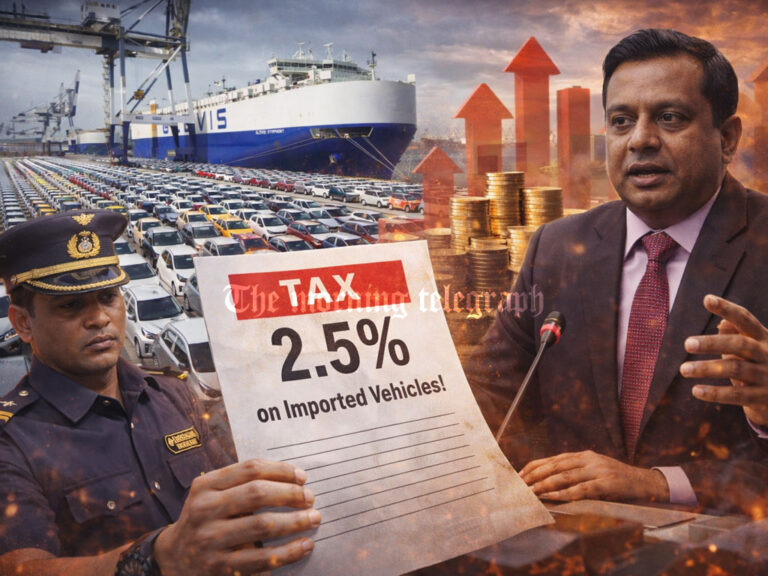

Sri Lanka Customs has imposed a penalty of around Rs. 70 million on a recently imported Rolls‑Royce Phantom after officials determined that the vehicle was wrongly declared, according to two government sources.

Officials familiar with the matter said the importer had declared the vehicle at a value of 417,000 sterling pounds, inclusive of a 20 percent tax in the United Kingdom, claiming it was a Rolls-Royce Phantom Auto model. However, Customs officers observed that the vehicle’s length and wheel size did not match the specifications of the standard Phantom Auto.

“That amount was for a Rolls-Royce Phantom Auto car and the importer claimed it was of that model. But the length and wheel size were larger than the Rolls-Royce Phantom Auto model,” one official said.

Further checks revealed that the car was in fact a Rolls-Royce Phantom Auto EWB, or extended wheelbase version. Officials said the correct value of this model is about 479,000 sterling pounds, including UK taxes. As a result, the importer was required to pay a total of nearly Rs. 370 million, which includes the penalty for incorrect declaration.

Customs Spokesman Chandana Punchihewa was not immediately available for comment.

The case gained public attention after Rolls-Royce Phantoms went viral on social media. Sri Lankan businessman Dudley Sirisena had claimed in a post that his vehicle was one of only 25 units produced worldwide to mark the brand’s 100th anniversary. This sparked online speculation that a Phantom “Centenary” model had been imported.

Officials, however, said that if the vehicle were proven to be a Centenary edition, the tax liability alone would exceed Rs. 1 billion. “As far as we know, it is not a Centenary model. But if Customs finds otherwise, the importer will be liable to pay more taxes and penalties,” a government source said.