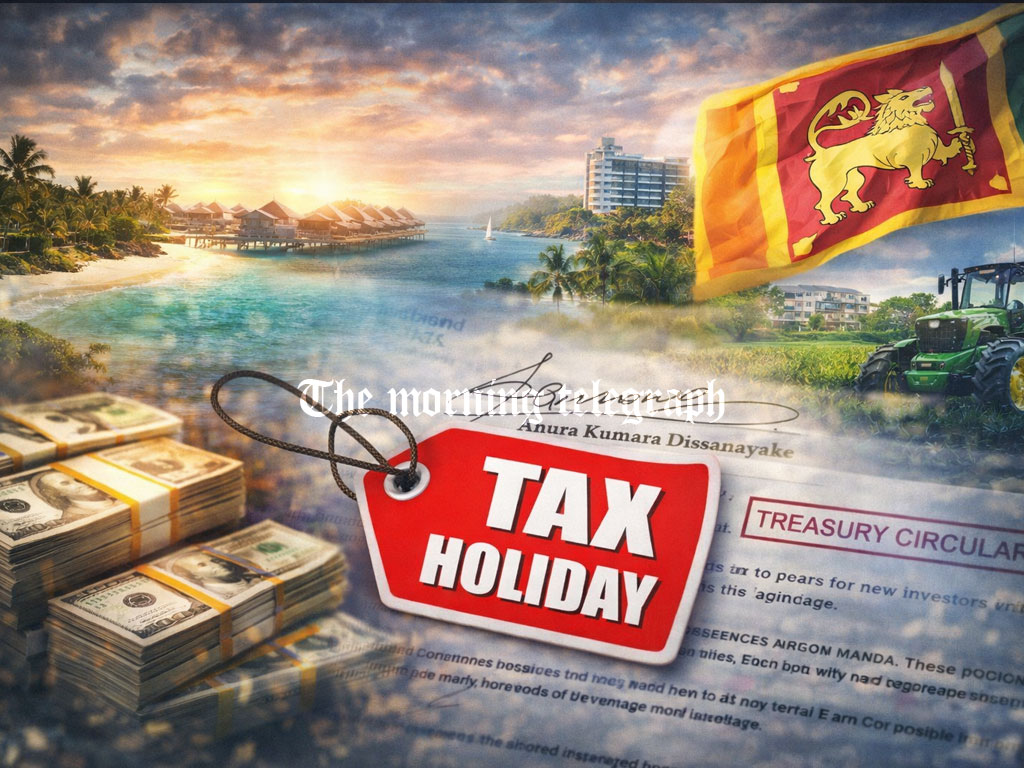

Sri Lanka rolls out sweeping tax concessions for high-value investors, promising long-term Corporate Income Tax exemptions in a bold bid to accelerate economic recovery and attract foreign direct investment.

The government has announced a fresh package of tax holidays ranging from six to ten years for new investors, under a newly issued Treasury circular. The initiative targets key growth sectors including tourism, manufacturing, agriculture, and educational technology, signaling a renewed push to stimulate foreign direct investment and strengthen Sri Lanka’s domestic economy.

Issued by President Anura Kumara Dissanayake in his capacity as Minister of Finance, Planning and Economic Development, the circular requires prospective investors to commit between US$50 million and US$300 million. Projects must also generate at least 100 to 250 local employment opportunities, ensuring job creation alongside capital inflows.

For tourism and leisure-related mega projects, the minimum investment threshold is set at US$300 million, with tax holidays extending up to ten years. Approved investors will enjoy exemptions from Corporate Income Tax during the designated period, along with duty-free importation of capital goods and construction materials during implementation.

However, the circular makes it clear that motor vehicles imported for personal or travel use will not qualify for tax concessions and will remain subject to existing taxes.