The Central Bank of Sri Lanka is set to hold significant auctions of treasury bonds and bills this week, raising over a quarter trillion rupees to fund government operations. On November 12, the Central Bank will auction B-category treasury bonds worth 85 billion rupees, maturing in 2028, and A-category bonds worth 47.5 billion rupees, maturing in 2032, totaling 132.5 billion rupees.

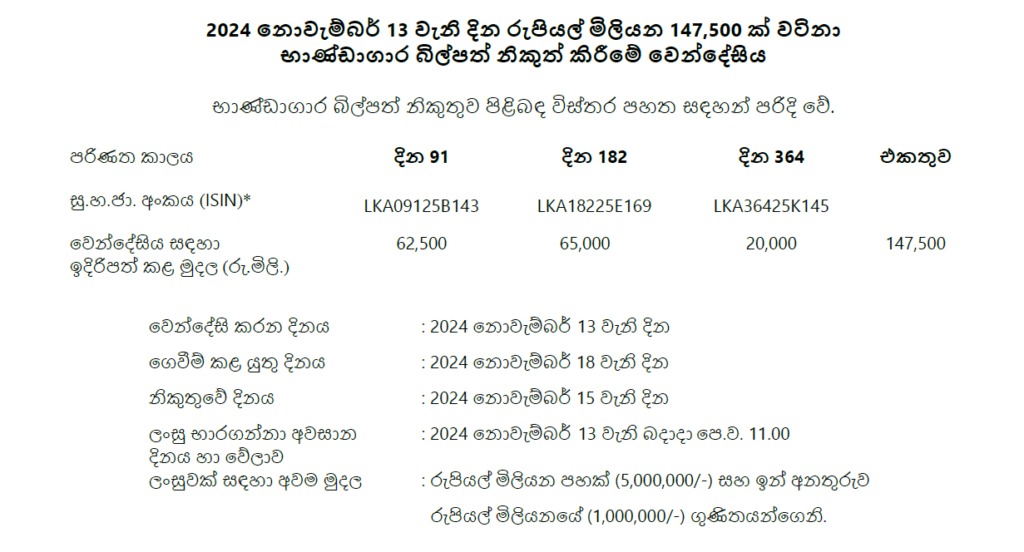

The following day, November 13, a separate auction will see the issuance of treasury bills totaling 147.5 billion rupees. This includes 62.5 billion rupees in 91-day bills, 65 billion rupees in 182-day bills, and 20 billion rupees in 364-day bills.

The bond and bill sales come as Sri Lanka seeks to manage liquidity and raise capital amid ongoing economic challenges. The Central Bank expects investor interest to bolster the issuance, with maturity periods offering options from short-term to long-term commitments.