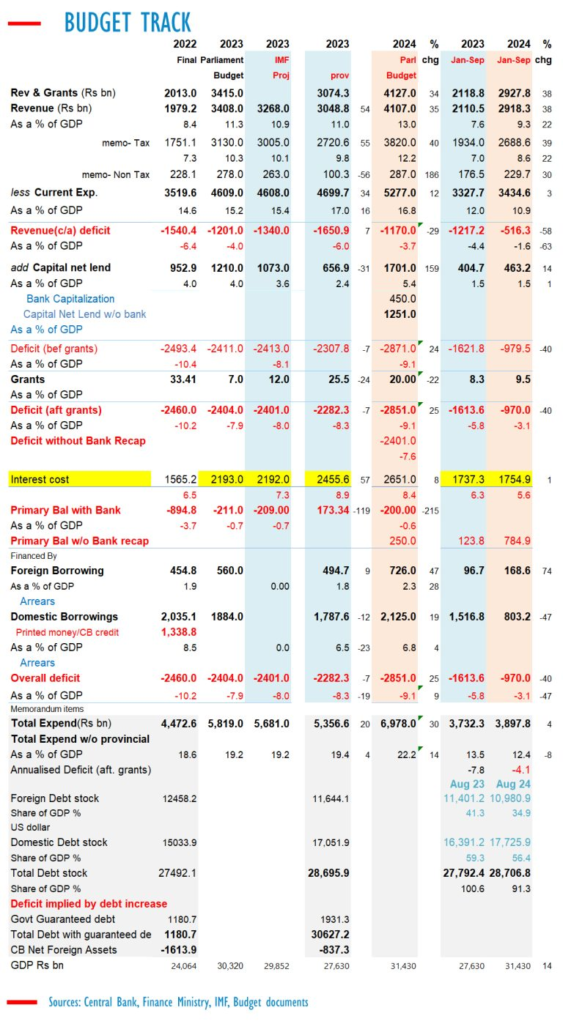

Sri Lanka’s fiscal position improved significantly in the first nine months of 2024, with the budget deficit dropping 40% and tax revenue rising 39% year-on-year to 2,918.3 billion rupees, according to official data. The surge in tax collections aligns with the government’s annual projection of a 40% increase, though revenue inflow varied across months.

Non-tax revenues also saw a 30% uptick, reaching 229.7 billion rupees. Current expenditure rose marginally by 3%, supported by fiscal discipline, a steady interest bill, and economic stability stemming from deflationary monetary policy and a strengthening rupee.

Total revenue accounted for 9.3% of GDP, up from 7.6% in 2023, and the government is targeting at least 13% of GDP revenue for the year. The current account deficit—the gap between revenues and current spending—declined 58% to 516.3 billion rupees, representing 1.6% of GDP.

Capital spending increased by 14% to 463.2 billion rupees, as the country gradually emerges from its debt default, enabling expanded project financing. Interest expenses remained stable, increasing only 1% to 1,754.9 billion rupees, as Treasury yields eased amid deflationary monetary policies.

The primary balance, which excludes interest payments from the overall deficit, recorded a surplus of 784.9 billion rupees, a significant improvement from the 123.8 billion rupees surplus in 2023. Total government expenditure rose modestly by 4% to 3,897.8 billion rupees but fell as a percentage of GDP to 12.4% from 13.5% last year.

Sri Lanka’s central government debt decreased to 91.6% of projected GDP by September, down from 100.6% in 2023. Foreign debt declined absolutely to 10,980 billion rupees from 11,600 billion rupees in December 2023, aided by rupee appreciation and repayments.

The improvement comes as Sri Lanka regains the ability to settle foreign debts from rupee cash flows, reversing a trend of unsustainable borrowing that culminated in the 2022 default. Since late 2022, the nation has strengthened its monetary framework, reducing reliance on money printing and rebuilding fiscal stability.