Sri Lanka’s Trade Deficit on Track to Exceed $6 Billion in 2024

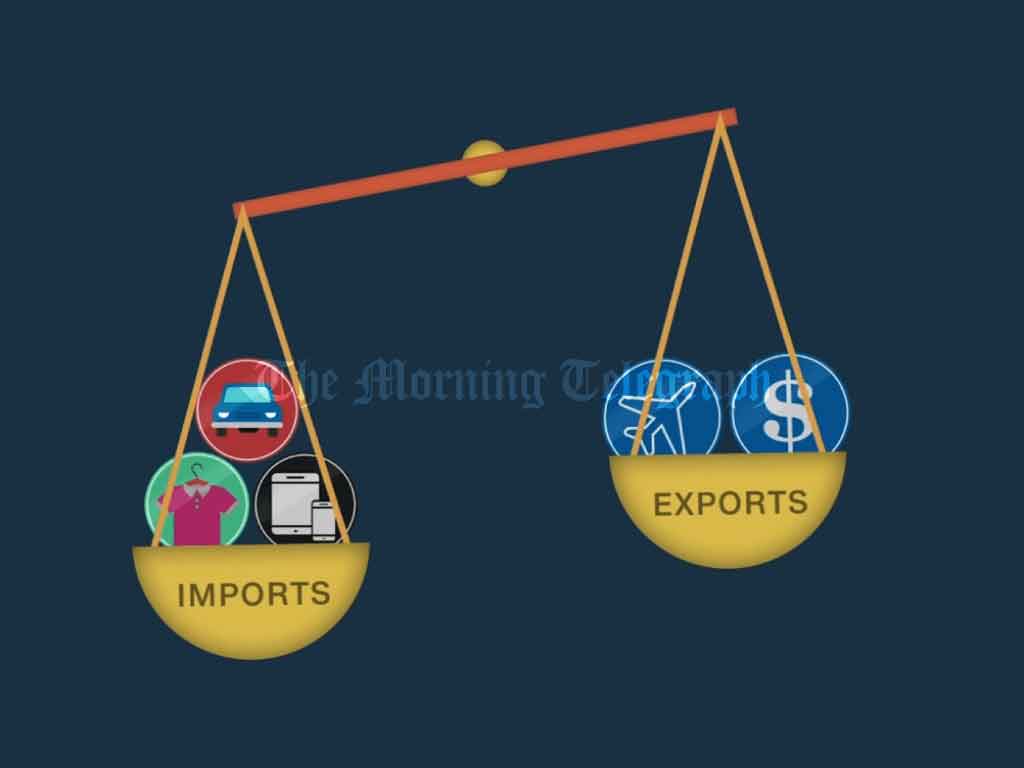

Sri Lanka’s trade balance deficit for 2024 is projected to surpass $6 billion, raising concerns about the country’s economic stability. This comes despite moderate growth in exports, as rising import costs continue to outpace export earnings.

Export Growth Fails to Offset Imports

From January to October 2024, Sri Lanka earned $10.68 billion from the export of goods. This marks a 7.7% increase compared to the same period in 2023, according to Professor Wasantha Athukorala of the Department of Economics and Statistics at the University of Peradeniya. The growth in export earnings indicates progress in key export sectors, such as textiles, tea, and rubber. However, the gains have been insufficient to bridge the trade gap.

Soaring Import Expenditure

During the same period, the expenditure on goods imports reached $15.42 billion, reflecting a 10.7% increase compared to last year. The surge in import costs has been attributed to several factors, including rising global commodity prices, higher fuel costs, and increased domestic demand for essential and non-essential goods.

A Widening Trade Deficit

The gap between exports and imports resulted in a trade account deficit of $4.74 billion for the first ten months of 2024. This deficit is expected to widen further in the last two months of the year, potentially exceeding $6 billion, warns Professor Athukorala. If this forecast holds, it will represent one of the largest trade deficits in recent years.

Economic Implications

The widening trade deficit poses multiple challenges for Sri Lanka’s economy, including:

- Pressure on Foreign Exchange Reserves: The gap between foreign currency inflows from exports and outflows for imports could lead to further depletion of Sri Lanka’s already strained foreign exchange reserves.

- Currency Depreciation Risks: An increased demand for foreign currency to fund imports could weaken the Sri Lankan rupee, leading to higher inflation and increased costs for consumers.

- Debt Repayment Challenges: With a substantial portion of foreign earnings tied to debt servicing, a large trade deficit could worsen the country’s financial vulnerability.

Strategies for Improvement

To address the trade imbalance, Sri Lanka must take a multi-faceted approach:

- Boosting Exports: Policies aimed at increasing export volumes and diversifying the export base could help generate more foreign exchange. Investments in value-added industries and new markets would also be crucial.

- Reducing Import Dependency: Encouraging local production of goods currently imported and promoting efficient use of resources could ease the pressure on import expenditure.

- Attracting Foreign Investment: Strengthening foreign direct investment (FDI) in export-oriented sectors can provide a much-needed boost to the trade balance.

As the year draws to a close, the focus remains on mitigating the deficit and ensuring economic stability. Policymakers will need to balance short-term measures with long-term reforms to address the root causes of Sri Lanka’s trade challenges.Sri Lanka’s Trade Deficit on Track to Exceed $6 Billion in 2024

Sri Lanka’s trade balance deficit for 2024 is projected to surpass $6 billion, raising concerns about the country’s economic stability. This comes despite moderate growth in exports, as rising import costs continue to outpace export earnings.

Export Growth Fails to Offset Imports

From January to October 2024, Sri Lanka earned $10.68 billion from the export of goods. This marks a 7.7% increase compared to the same period in 2023, according to Professor Wasantha Athukorala of the Department of Economics and Statistics at the University of Peradeniya. The growth in export earnings indicates progress in key export sectors, such as textiles, tea, and rubber. However, the gains have been insufficient to bridge the trade gap.

Soaring Import Expenditure

During the same period, the expenditure on goods imports reached $15.42 billion, reflecting a 10.7% increase compared to last year. The surge in import costs has been attributed to several factors, including rising global commodity prices, higher fuel costs, and increased domestic demand for essential and non-essential goods.

A Widening Trade Deficit

The gap between exports and imports resulted in a trade account deficit of $4.74 billion for the first ten months of 2024. This deficit is expected to widen further in the last two months of the year, potentially exceeding $6 billion, warns Professor Athukorala. If this forecast holds, it will represent one of the largest trade deficits in recent years.

Economic Implications

The widening trade deficit poses multiple challenges for Sri Lanka’s economy, including:

- Pressure on Foreign Exchange Reserves: The gap between foreign currency inflows from exports and outflows for imports could lead to further depletion of Sri Lanka’s already strained foreign exchange reserves.

- Currency Depreciation Risks: An increased demand for foreign currency to fund imports could weaken the Sri Lankan rupee, leading to higher inflation and increased costs for consumers.

- Debt Repayment Challenges: With a substantial portion of foreign earnings tied to debt servicing, a large trade deficit could worsen the country’s financial vulnerability.

Strategies for Improvement

To address the trade imbalance, Sri Lanka must take a multi-faceted approach:

- Boosting Exports: Policies aimed at increasing export volumes and diversifying the export base could help generate more foreign exchange. Investments in value-added industries and new markets would also be crucial.

- Reducing Import Dependency: Encouraging local production of goods currently imported and promoting efficient use of resources could ease the pressure on import expenditure.

- Attracting Foreign Investment: Strengthening foreign direct investment (FDI) in export-oriented sectors can provide a much-needed boost to the trade balance.

As the year draws to a close, the focus remains on mitigating the deficit and ensuring economic stability. Policymakers will need to balance short-term measures with long-term reforms to address the root causes of Sri Lanka’s trade challenges.

Sri Lanka’s trade balance deficit for 2024 is projected to surpass $6 billion, raising concerns about the country’s economic stability. This comes despite moderate growth in exports, as rising import costs continue to outpace export earnings.

Export Growth Fails to Offset Imports

From January to October 2024, Sri Lanka earned $10.68 billion from the export of goods. This marks a 7.7% increase compared to the same period in 2023, according to Professor Wasantha Athukorala of the Department of Economics and Statistics at the University of Peradeniya. The growth in export earnings indicates progress in key export sectors, such as textiles, tea, and rubber. However, the gains have been insufficient to bridge the trade gap.

Soaring Import Expenditure

During the same period, the expenditure on goods imports reached $15.42 billion, reflecting a 10.7% increase compared to last year. The surge in import costs has been attributed to several factors, including rising global commodity prices, higher fuel costs, and increased domestic demand for essential and non-essential goods.

A Widening Trade Deficit

The gap between exports and imports resulted in a trade account deficit of $4.74 billion for the first ten months of 2024. This deficit is expected to widen further in the last two months of the year, potentially exceeding $6 billion, warns Professor Athukorala. If this forecast holds, it will represent one of the largest trade deficits in recent years.

Economic Implications

The widening trade deficit poses multiple challenges for Sri Lanka’s economy, including:

- Pressure on Foreign Exchange Reserves: The gap between foreign currency inflows from exports and outflows for imports could lead to further depletion of Sri Lanka’s already strained foreign exchange reserves.

- Currency Depreciation Risks: An increased demand for foreign currency to fund imports could weaken the Sri Lankan rupee, leading to higher inflation and increased costs for consumers.

- Debt Repayment Challenges: With a substantial portion of foreign earnings tied to debt servicing, a large trade deficit could worsen the country’s financial vulnerability.

Strategies for Improvement

To address the trade imbalance, Sri Lanka must take a multi-faceted approach:

- Boosting Exports: Policies aimed at increasing export volumes and diversifying the export base could help generate more foreign exchange. Investments in value-added industries and new markets would also be crucial.

- Reducing Import Dependency: Encouraging local production of goods currently imported and promoting efficient use of resources could ease the pressure on import expenditure.

- Attracting Foreign Investment: Strengthening foreign direct investment (FDI) in export-oriented sectors can provide a much-needed boost to the trade balance.

As the year draws to a close, the focus remains on mitigating the deficit and ensuring economic stability. Policymakers will need to balance short-term measures with long-term reforms to address the root causes of Sri Lanka’s trade challenges.