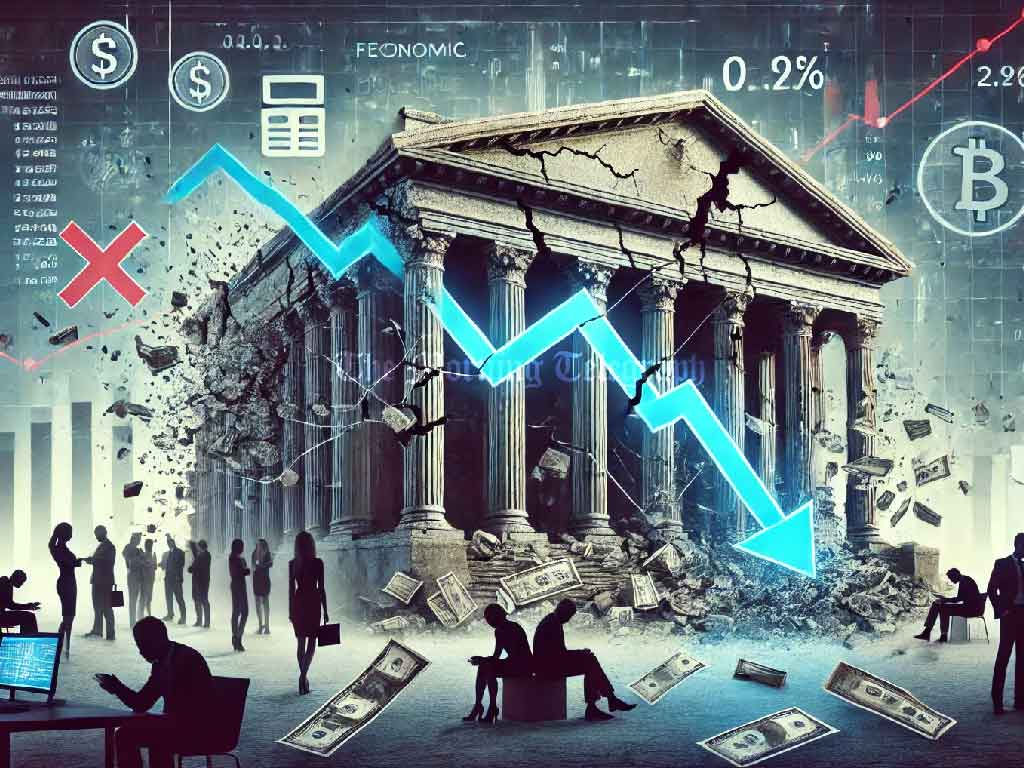

The sharp increase in the withholding tax on bank deposits has triggered a widespread withdrawal of fixed deposits, severely impacting the liquidity of banks in Sri Lanka. Reports reveal that many depositors are shifting their funds toward alternative investment options, such as the Colombo Stock Exchange and other high-return ventures. This shift has fuelled a notable rise in stock market activity.

The liquidity crisis has not only disrupted the banking sector but has also affected several large corporations dependent on stable banking operations. Industry experts warn that the exodus of funds from fixed deposits may limit banks’ ability to provide loans and maintain financial stability.

Sri Lanka currently holds about 65 million bank accounts, with total deposits valued at approximately 1,700 billion rupees. This unprecedented outflow of funds from banks is creating challenges for financial institutions to meet short-term liquidity demands.

Economists point to the recent tax hike as a key driver of the current trend, with depositors seeking more lucrative, tax-efficient options. This has raised concerns about the potential long-term consequences on the banking system and the broader economy, including reduced capital for loans and a possible slowdown in economic growth. The government has yet to address these emerging issues, leaving financial experts and institutions to navigate an increasingly volatile environment.