Freelancers and individuals in Sri Lanka who provide services to overseas clients and receive foreign exchange through local banks will now be subject to a 15% tax on their earnings, a tax expert has confirmed.

Sarah Afker, Head of Tax Services at BDO Sri Lanka, stated that while the 15% tax on service exports was initially mentioned as a corporate tax in the budget, subsequent amendments to the Inland Revenue Act revealed that it would also apply to individuals.

Previously, such foreign earnings were tax-exempt to encourage remittances into the country. However, under the new regulations taking effect from April 1, 2025, foreign-sourced income, including freelance earnings, will be taxed at a flat 15%.

“From April 1st, any foreign-sourced income, including service exports, will be liable for a 15% tax,” Afker said at a post-budget seminar hosted by the Economics Students’ Association of the University of Colombo.

Under the new income tax structure, individual earnings up to LKR 1.8 million remain tax-exempt, while the next LKR 500,000 will be taxed at 6%. The previous 12% tax rate has been removed, with earnings in the next LKR 500,000 slab taxed at 18%. However, foreign exchange earnings will now be taxed at 15% without an upper limit.

While companies engaged in service exports are taxed only on profits after deducting expenses, individuals may also attempt to deduct expenses by submitting an income statement, Afker suggested.

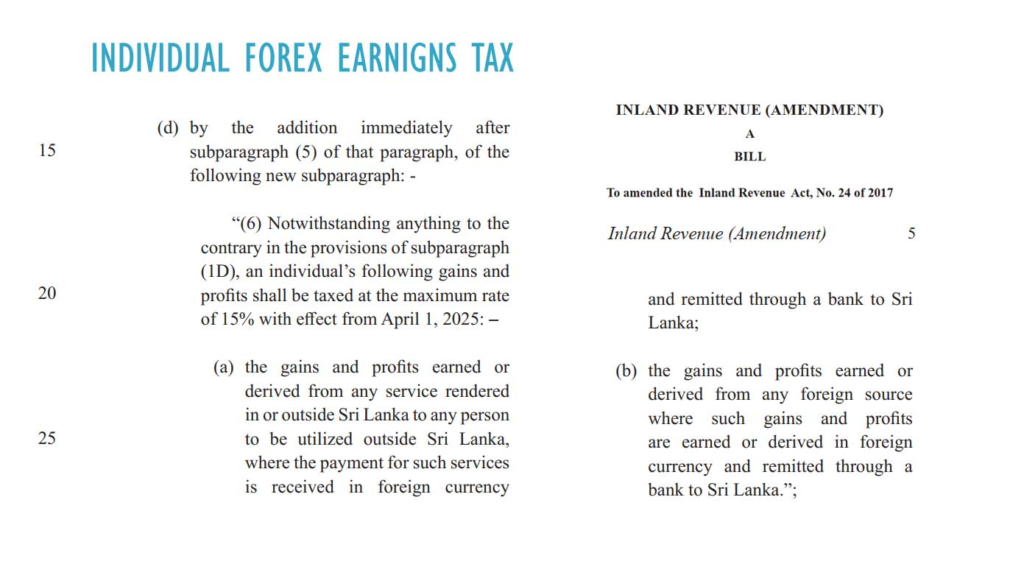

The amendments to the Inland Revenue Act specify that the tax applies to:

- Services rendered within or outside Sri Lanka for overseas clients, where payments are received in foreign currency and remitted to Sri Lanka through banks – 15%.

- Profits earned from any foreign source, provided they are received in foreign currency and transferred through banks to Sri Lanka – 15%.

The new taxation policy marks a significant shift in Sri Lanka’s approach to taxing foreign exchange inflows and could impact the growing freelancer and remote work community in the country.