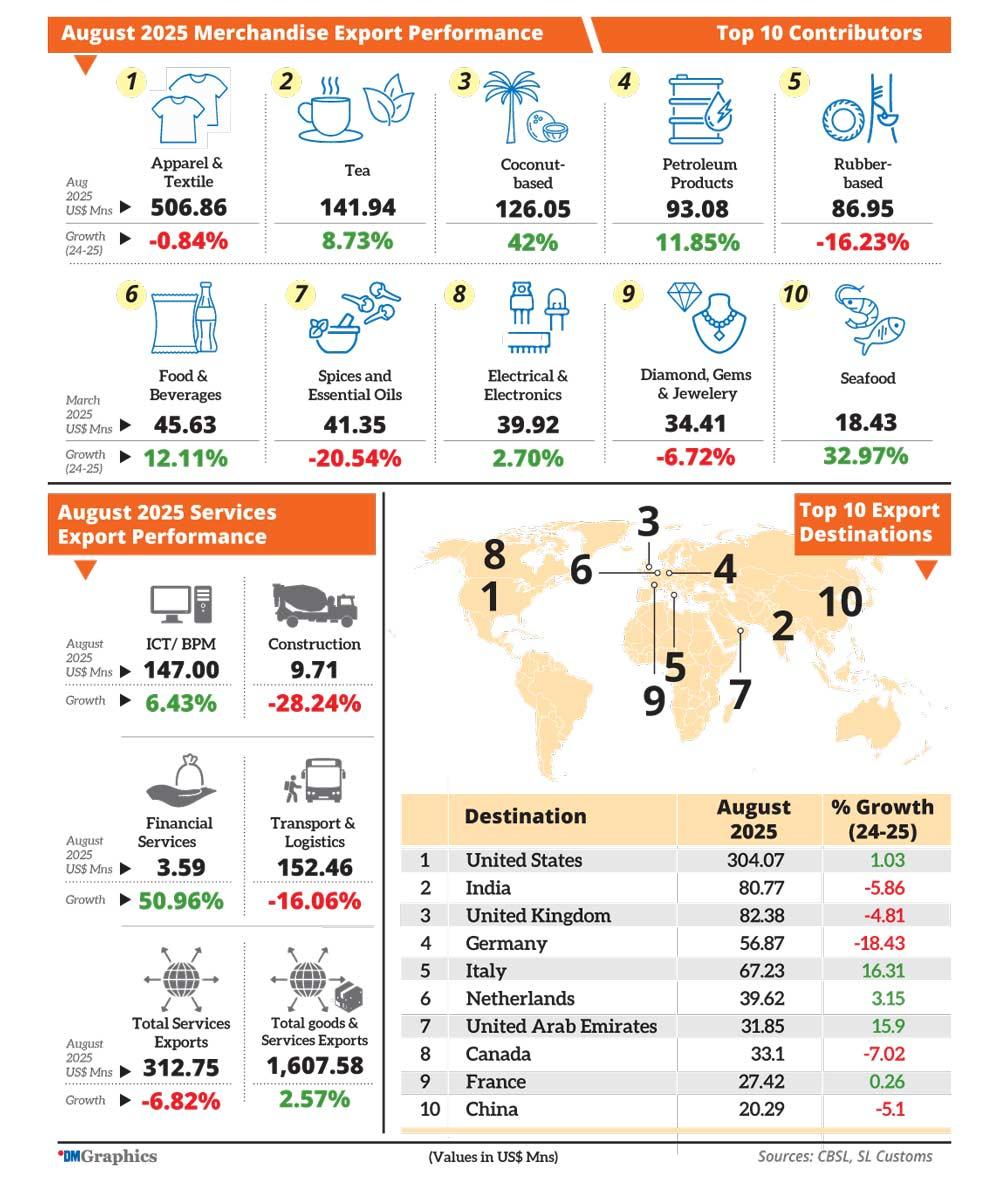

Sri Lanka’s export earnings rose 2.6 percent year-on-year in August 2025 to US$ 1.61 billion, powered by strong growth in agriculture-based exports and ICT services, even as apparel shipments – the country’s largest export sector – showed signs of weakness.

Sri Lanka’s exports continued their steady growth trajectory in August 2025, with total earnings reaching US$ 1.61 billion, according to fresh data released by the Export Development Board (EDB). The monthly increase of 2.6 percent compared to the previous year underscored the resilience of the country’s export base, despite ongoing volatility in global trade and softer performance in traditional sectors such as apparel and textiles.

The cumulative export figure for the first eight months of 2025 stood at US$ 11.55 billion, reflecting a 6.6 percent year-on-year increase. Out of this total, merchandise exports contributed US$ 9.09 billion, while services accounted for US$ 2.46 billion. The services component highlighted robust performances in information and communications technology (ICT), business process management (BPM), logistics, construction, and financial services.

Agriculture exports take the lead

Agriculture-based exports emerged as the star performers in August. Tea exports surged nearly 9 percent from a year earlier, generating US$ 141.9 million in earnings. This growth was largely driven by increased shipments to markets such as the United Arab Emirates, Turkey, Russia, and Iran, which helped offset sluggish demand in other regions.

Coconut-based products also showed a remarkable surge, climbing 42 percent in August. Kernel products, fibre, and shell categories all saw higher demand, indicating a broader diversification of export opportunities within the coconut industry. Seafood exports contributed further strength, expanding by 33 percent, supported by strong overseas demand and improvements in value-added processing.

The cumulative figures from January to August reinforced this trend, with tea earnings up 8.9 percent to US$ 1.03 billion, coconut-based products up an impressive 38 percent to US$ 786.6 million, and food and beverages exports rising by 22 percent, primarily driven by processed food shipments.

Apparel and other sectors face headwinds

By contrast, apparel and textiles – Sri Lanka’s single largest export earner – posted a marginal decline in August, with earnings slipping 0.8 percent to US$ 506.9 million. The slowdown was attributed to weaker demand in key Western markets amid changing global consumer trends and cautious retail orders. However, cumulative apparel earnings for the first eight months still reflected a 6.8 percent increase, rising to US$ 3.59 billion.

Other sectors were less encouraging. Rubber exports dropped 16 percent in August due to reduced demand for tyres, while spices contracted 21 percent, driven by a sharp fall in pepper exports to India. Diamonds, gems, and jewellery also reported a decline, reflecting global market softness in luxury commodities.

Despite these setbacks, ICT and BPM services continued their upward trajectory. Export earnings from ICT services alone were estimated at US$ 147 million in August, reinforcing Sri Lanka’s growing reputation as a global outsourcing and digital services hub.

Export markets: US leads, India climbs to second

In terms of export destinations, the United States remained Sri Lanka’s top buyer, accounting for nearly a quarter of total merchandise exports. Exports to the US edged up 1 percent in August and grew 3.8 percent over the January to August period, reaching US$ 2 billion.

India overtook the United Kingdom to become Sri Lanka’s second-largest export market. Shipments to India rose 22 percent during the first eight months of 2025 to US$ 705 million, buoyed by rising demand for agricultural products, food, and industrial exports. By contrast, exports to the UK fell by almost 5 percent year-on-year in August, highlighting challenges in maintaining market share in traditional Western markets.

EDB outlook

Commenting on the figures, EDB Chairman Mangala Wijesinghe described the performance as evidence of exporters’ resilience. “This encouraging growth highlights Sri Lanka’s increasing integration into global trade and the success of our continued efforts to strengthen export competitiveness while diversifying market opportunities,” he said.

Wijesinghe also noted that while the EDB remains encouraged by these results, challenges remain. “While we celebrate this progress, we remain mindful of the challenges ahead. With sustained efforts to enhance competitiveness and expand market opportunities, we are confident of reaching the export target set for 2025,” he added.

Overall, Sri Lanka’s August 2025 export performance reflected a delicate balance of strengths and weaknesses. Agricultural products, ICT services, and emerging food exports have provided momentum, while apparel and traditional commodities face headwinds. The strong performance in India and steady demand from the United States highlight the importance of diversifying markets, while the pressure in the UK underscores the risks of overdependence on traditional partners.

With US$ 11.55 billion in earnings already secured in the first eight months of the year, the export sector appears on track to meet its annual target, though the coming months will test its ability to withstand global uncertainties and sustain growth across both traditional and emerging markets.