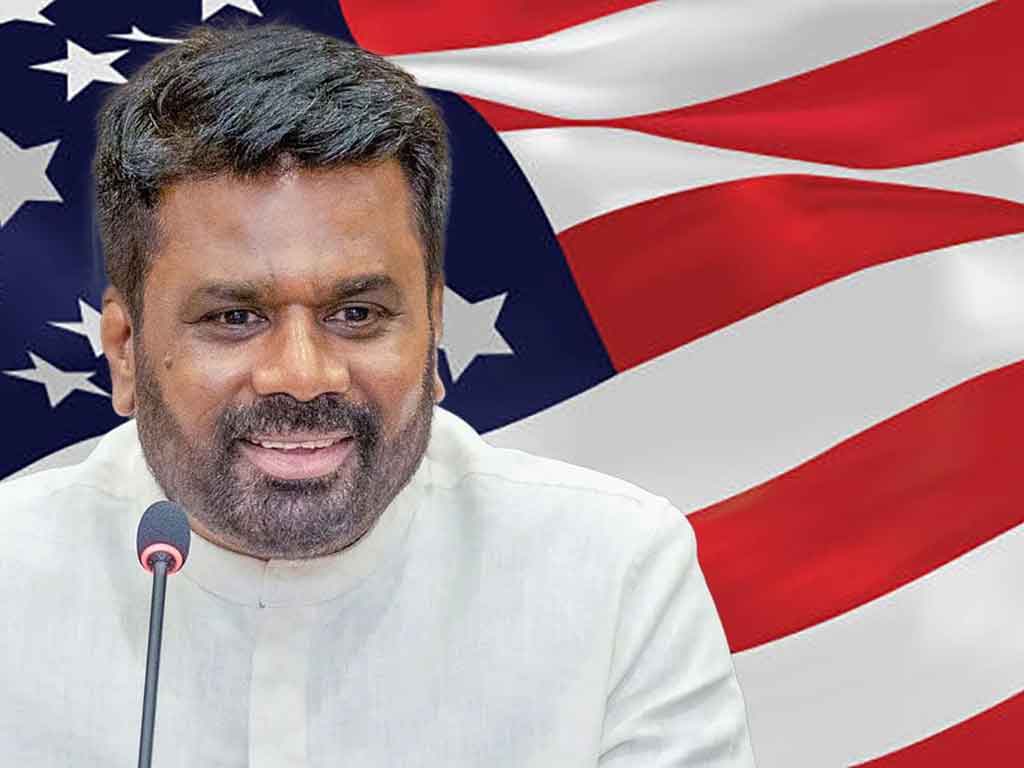

Amid growing concerns over global economic uncertainty, President Anura Kumara Dissanayake has assured a high-level American business delegation that Sri Lanka is now a safe, transparent, and investor-friendly destination—promising sweeping reforms and legal protections to restore international trust.

President Anura Kumara Dissanayake used his meeting with a group of American investors at the Presidential Secretariat to send a direct message: Sri Lanka is ready for business, and every investment that enters the country under the current administration will be secure. The President’s remarks were aimed at rebuilding confidence in a nation that has faced years of instability, corruption scandals, and regulatory failures that once discouraged foreign capital.

Speaking to influential American investors, including Crow Holdings Chairman Harlan Crow, Hudson Institute Chairman Sarah Stern, Eagle Capital Management’s Ravenel Curry, and Hudson Institute Fellow Walter Russell Mead, the President emphasized that Sri Lanka has entered a new phase. Unlike in the past, when investments were undermined by irregularities, favoritism, and legal uncertainty, the current government is committed to sweeping reforms that create a predictable and transparent investment environment.

The President explained that the government is drafting an Investment Protection Act designed to guarantee investor rights while strengthening Sri Lanka’s ability to attract long-term, sustainable foreign capital. He acknowledged that earlier administrations had mishandled foreign investments, creating reputational risks for the country, but insisted that his government is committed to eliminating corruption, ensuring regulatory clarity, and embedding protections within a democratic legal framework.

Investment security, he stressed, will not be limited to financial assurances. The government is actively addressing broader socio-political risks that have historically undermined Sri Lanka’s attractiveness as a destination. This includes tackling racism and religious fanaticism, fostering national unity, modernizing the public service, and expanding digitalization to overcome technological barriers. By ensuring a socially stable environment alongside legal protections, the President argued, Sri Lanka will position itself as one of South Asia’s safest and most reliable investment destinations.

The delegation of American business leaders was reminded that Sri Lanka has always been strategically located in the Indian Ocean, giving investors access to vital trade routes and regional markets. However, the President admitted that geography alone is not enough to attract capital. Global investors, particularly those from the United States, require guarantees that their assets will not be threatened by political volatility, arbitrary policy changes, or systemic corruption. To this end, the government is not only rewriting laws but also reshaping institutions to restore investor trust.

The President’s message, however, carries risks as well as opportunities. While international assurances are powerful signals to markets, failure to deliver on these promises could further damage Sri Lanka’s credibility. Investors have been burned before, with stalled projects, regulatory bottlenecks, and political uncertainty eroding confidence. The proposed reforms, therefore, represent a high-stakes gamble: if they succeed, Sri Lanka could attract billions in fresh capital and reposition itself as a key South Asian hub. If they fail, the country risks deepening its financial isolation and losing credibility in the eyes of its most powerful trading partners.

The presence of prominent US business and policy figures underscored the significance of the moment. For American investors, Sri Lanka offers opportunities in infrastructure, tourism, energy, digital services, and logistics. But it also presents challenges in governance and transparency. By assuring investors that these issues are being directly addressed, President Dissanayake signaled that his administration sees foreign investment not only as a financial priority but as a political test of legitimacy.

Ultimately, the President’s message was clear: Sri Lanka can no longer afford to repeat the mistakes of the past. Investment must be protected by law, governance must be accountable, and stability must be guaranteed. For investors weighing risks and opportunities in the global market, Sri Lanka’s gamble on reform could either transform the island into a magnet for capital or expose it to further disappointment. The world, and particularly the United States, will be watching closely to see whether these promises translate into measurable change.