Sri Lanka’s treasury has hit an unprecedented milestone, overflowing with more than a trillion rupees in excess funds, revealing a dramatic and historic shift in government revenue driven by soaring taxes, revived imports, and slowed state spending.

Sri Lanka’s economic conversation changed dramatically during the recent budget debate when Samagi Jana Balawegaya MP Dr. Harsha de Silva declared in Parliament that “the treasury has overflowed for the first time in our known history.” He said the country’s treasury, which traditionally operated on overdraft, now holds an unexpected surplus: “a trillion rupees more money.” His claim immediately captured public attention and sparked debate about how such a dramatic change became possible during a period when many people still struggle with high living costs, inflation, and economic uncertainty.

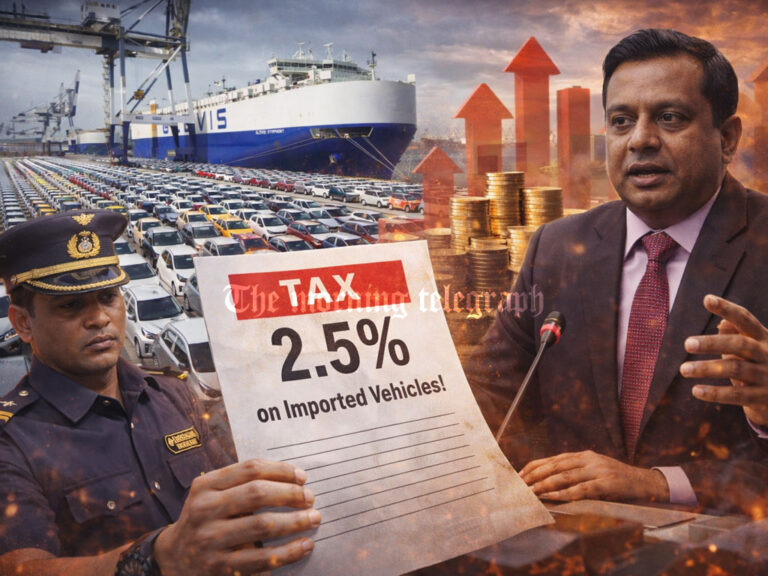

According to Dr. de Silva, several major developments have contributed to this sudden surge in government revenue. The Ministry of Finance, Planning and Economic Development confirmed that Sri Lanka is now approaching the highest primary surplus ever recorded. This increase is driven largely by massive tax revenue, including VAT, income tax, excise duties, customs duties, and the revival of vehicle imports. At the same time, the slowdown in capital expenditure has lowered government spending, widening the fiscal surplus even more.

The Ministry of Finance reports that Sri Lanka’s primary account surplus rose sharply from Rs. 648.8 billion during the first eight months of 2024 to Rs. 1,276.5 billion during the same period in 2025. The tax-to-GDP ratio is expected to reach 14.8 percent in 2025, exceeding even IMF targets. The Inland Revenue Department announced that as of November 17, 2025, Sri Lanka recorded the highest tax collection in its history: Rs. 2,002,241 million, an increase of more than Rs. 60 billion compared to 2024.

According to the Ministry, ten main reasons explain this revenue boom. First, income tax receipts increased by 12.4 percent, adding Rs. 77.7 billion. This was driven by policy changes affecting personal income tax, corporate tax, withholding tax, and advance income tax. Wage increases in both the public and informal private sectors also pushed up taxable income. Second, VAT revenue surged by 28.7 percent, adding Rs. 241.8 billion. This followed the VAT rate increase from 15 percent to 18 percent, a lower registration threshold, and renewed vehicle imports. VAT on imports rose sharply, while VAT on domestic activity grew significantly as well.

Third, excise duty on motor vehicles increased due to the removal of import restrictions and a 5.9 percent inflation-indexed rate revision. This caused a staggering 640.5 percent jump in vehicle excise revenue, contributing Rs. 234 billion. Fourth, excise revenue from alcohol increased by 9.1 percent or Rs. 12.1 billion following the same inflation-based tax adjustment. Fifth, special commodity tax revenue rose by 54.2 percent, reaching Rs. 36.4 billion. Increased rates on onions and potatoes, along with higher import volumes, fuelled this rise.

Sixth, social security tax revenue increased by 18.8 percent or Rs. 30.2 billion, largely because of increased economic activity and more efficient tax administration. Registered taxpayer files rose to 14,898 in 2025 from 11,083 in 2024. Seventh, customs import duty revenue grew significantly as imports increased, especially motor vehicles. Customs duty rose by 117.5 percent, adding Rs. 81.6 billion to state revenue. Eighth, cess tax revenue grew by 8.8 percent or Rs. 4.6 billion, also linked to the rise in imports.

Ninth, non-tax revenue increased by 8.1 percent, or Rs. 17 billion, driven by interest income, rental earnings, fines, administrative fees, and social security contributions. And tenth, the slow implementation of capital expenditure reduced state spending. Public investment fell from Rs. 454.7 billion in 2024 to Rs. 338.8 billion in 2025. The Ministry noted that only 25.8 percent of the annual public investment estimate had been achieved, significantly boosting the treasury’s balance.

Together, these factors created a revenue surge that has sparked a national conversation: is this a sign of economic recovery or simply the result of heavier taxation and lower development spending?

The Ministry of Finance maintains that the revenue increase reflects a more disciplined fiscal environment, strengthened tax administration, and a rebound in economic activity. Yet critics argue that high taxes and reduced public investment place significant pressure on citizens and stall essential development projects. Dr. de Silva’s revelation highlights both sides of the economic equation. On one hand, Sri Lanka has achieved a historic fiscal surplus, surpassing IMF benchmarks and stabilizing government finances. On the other hand, whether this surplus translates into better public services, lower cost of living, or sustainable long-term growth remains uncertain.

As the country continues to navigate its economic recovery, the debate over taxation, revenue policy, and spending priorities is intensifying. The government’s challenge now is to balance revenue growth with inclusive development, ensuring that the burden on ordinary people does not overshadow the benefits of fiscal stability.