As Sri Lanka struggles to rebuild after Cyclone Ditva, global rating agency Moody’s warns the disaster could derail hard-won fiscal reforms and deepen the nation’s debt crisis.

Sri Lanka’s fragile fiscal recovery after its historic debt default now faces a fresh threat from the massive economic damage caused by Cyclone Ditva, according to new warnings from Moody’s Ratings. The rating agency said the government’s efforts at fiscal consolidation will be severely tested by the unexpected costs of post disaster reconstruction.

“While we do not expect a reversal of the government’s ongoing International Monetary Fund IMF programme and related reform commitments, the economic impact of the cyclone and the costs of managing its aftermath will likely undermine the fiscal consolidation expected after default,” Moody’s said.

Cyclone Ditva caused widespread destruction to critical infrastructure including roads, bridges, rail networks and power systems. These losses have disrupted supply chains, slowed business activity and weakened overall economic growth at a time when Sri Lanka is struggling to stabilize its economy.

“The sectors most affected are likely to be tourism, agriculture and manufacturing, which are key drivers of Sri Lanka’s economy and provide the majority of employment in the country,” the rating agency added. These sectors form the backbone of foreign exchange earnings and job creation, making the long term recovery even more challenging.

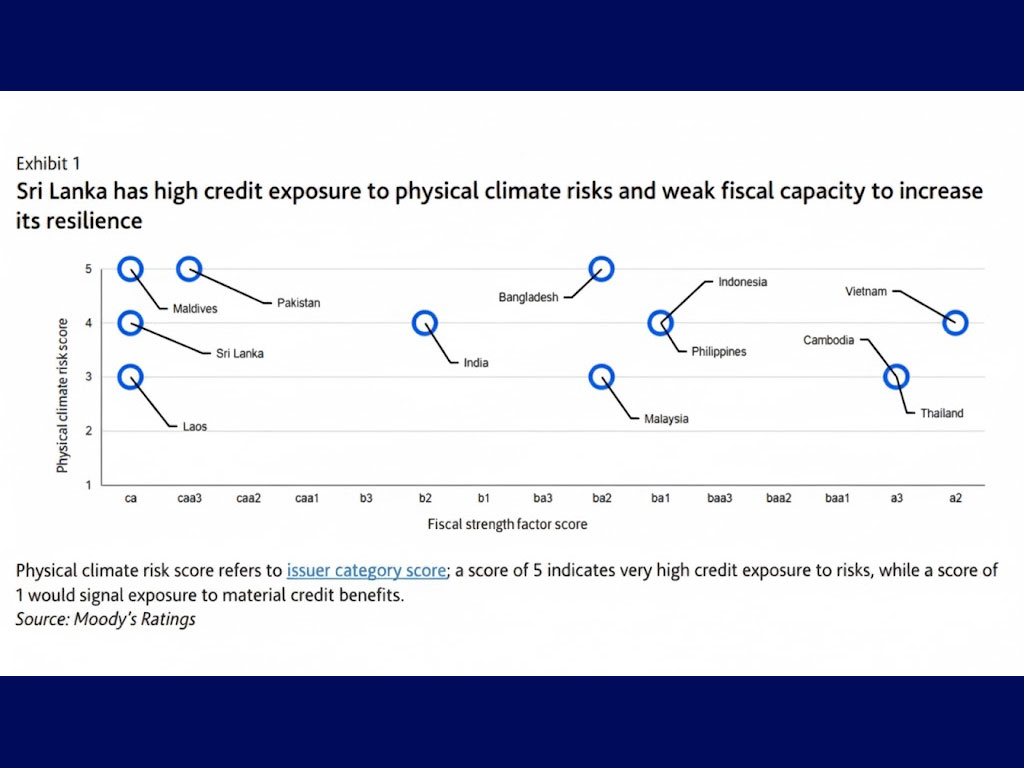

Moody’s also noted that Sri Lanka, along with Indonesia, the Philippines and Vietnam, carries high exposure to physical climate risks. However, Sri Lanka’s weak fiscal position leaves it with far less capacity to build resilience compared to regional peers.

Effective governance remains critical in reducing climate and economic risk. “Despite some progress in recent reforms, both Sri Lanka and Vietnam have governance issuer profile scores of 4, indicating high credit exposure to governance risks,” Moody’s said.