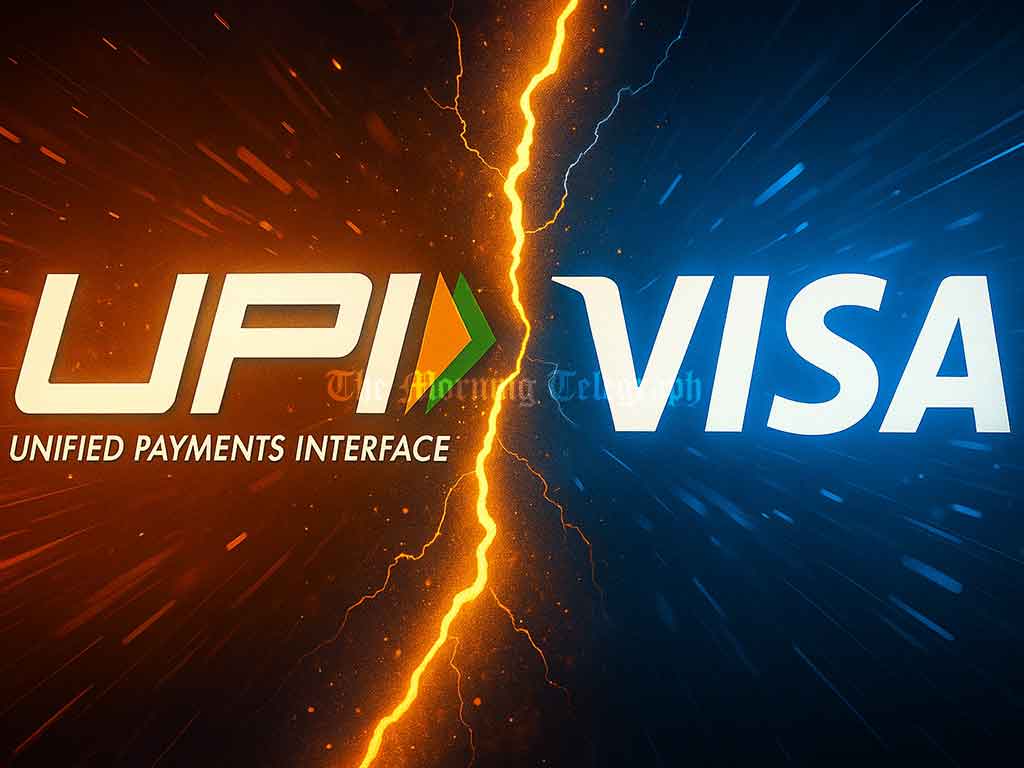

India’s homegrown UPI has just overtaken Visa in daily transactions proving that a free, local digital payment system can revolutionize a nation’s economy. So why is Sri Lanka still stuck paying foreign fees? The answer lies in vision and urgency.

India’s UPI Surpasses Visa: A Wake-Up Call for Sri Lanka’s Outdated Payment Systems

India’s Unified Payments Interface (UPI) has now done the unthinkable surpassing global giant Visa in daily digital transaction volumes. The shift represents more than just numbers; it’s a sign that the world is rapidly moving away from foreign-dominated payment systems. Meanwhile, Sri Lanka is still stuck relying on cards powered by global firms like Visa, Mastercard, and Amex.

Although the cards issued by Sri Lankan banks are branded locally, the underlying technology and transaction networks are foreign. Every time a Sri Lankan makes a card payment even within Sri Lanka, a portion of the transaction fee flows out of the country. This silent leakage of foreign exchange has become a norm.

Globally, many nations faced the same scenario. But some took a bold step: they created their own domestic digital payment networks. India is the most notable example. Launched in 2016, UPI or the Unified Payments Interface is a government-backed digital payment infrastructure that allows citizens and businesses to transact digitally without any fees.

With zero charges for P2P payments, QR codes, and online transfers, UPI quickly replaced cash in most day-to-day transactions. It’s why even small roadside stalls in India proudly display QR codes today. The result? UPI now processes more real-time transactions than any other system in the world.

Recent data shows that UPI is now clocking over 650 million transactions daily, while Visa stands at 639 million. In June 2024 alone, UPI recorded 18 billion transactions worth a staggering 24 trillion Indian rupees surpassing the country’s cash usage.

But India isn’t alone. Brazil’s government-backed Pix system modeled on similar principles has witnessed over 63 billion digital transactions in 2024 so far. Pix, like UPI, charges no transaction fees, making it the default digital method for millions of Brazilians.

These two examples make a compelling case: when a government empowers citizens with a fee-free digital platform, the results are transformative. So, does every country really need Visa, Mastercard, or Amex for domestic transactions?

The answer is no except for one crucial area: cross-border payments.

International transactions, such as when Sri Lankans travel abroad or shop online from foreign merchants, require a global payments infrastructure. That’s where Visa and Mastercard remain essential. But for transactions that take place entirely within Sri Lanka, the dependence on global payment systems is both costly and unnecessary.

Sri Lanka has attempted local solutions like LankaQR and JustPay, developed by LankaPay the Central Bank’s tech division. Yet, these platforms have seen limited success. High bank fees, lack of merchant adoption, and fragmented implementation have stifled their growth. Comparatively, UPI achieved mass adoption in under a decade with the help of clear government vision and zero-fee architecture.

If India with its complex and diverse social landscape could build and scale UPI to global dominance within just nine years, Sri Lanka must ask: What’s holding us back?

Digital payments are not just a matter of convenience, they are critical to retaining foreign exchange, modernizing the economy, and promoting financial inclusion. Every rupee saved in transaction fees is a rupee retained in the national economy.

The time has come for Sri Lanka to develop and aggressively push a zero-fee, unified domestic payment platform. As the world moves away from cash and toward real-time digital payments, this transformation is not just desirable it’s essential.

India’s triumph with UPI is a wake-up call. Sri Lanka must answer it.