Sri Lanka’s Central Bank has slashed the maximum leasing limit for private vehicles to 50%, dealing a fresh blow to car buyers as the country moves to curb import pressure and credit expansion.

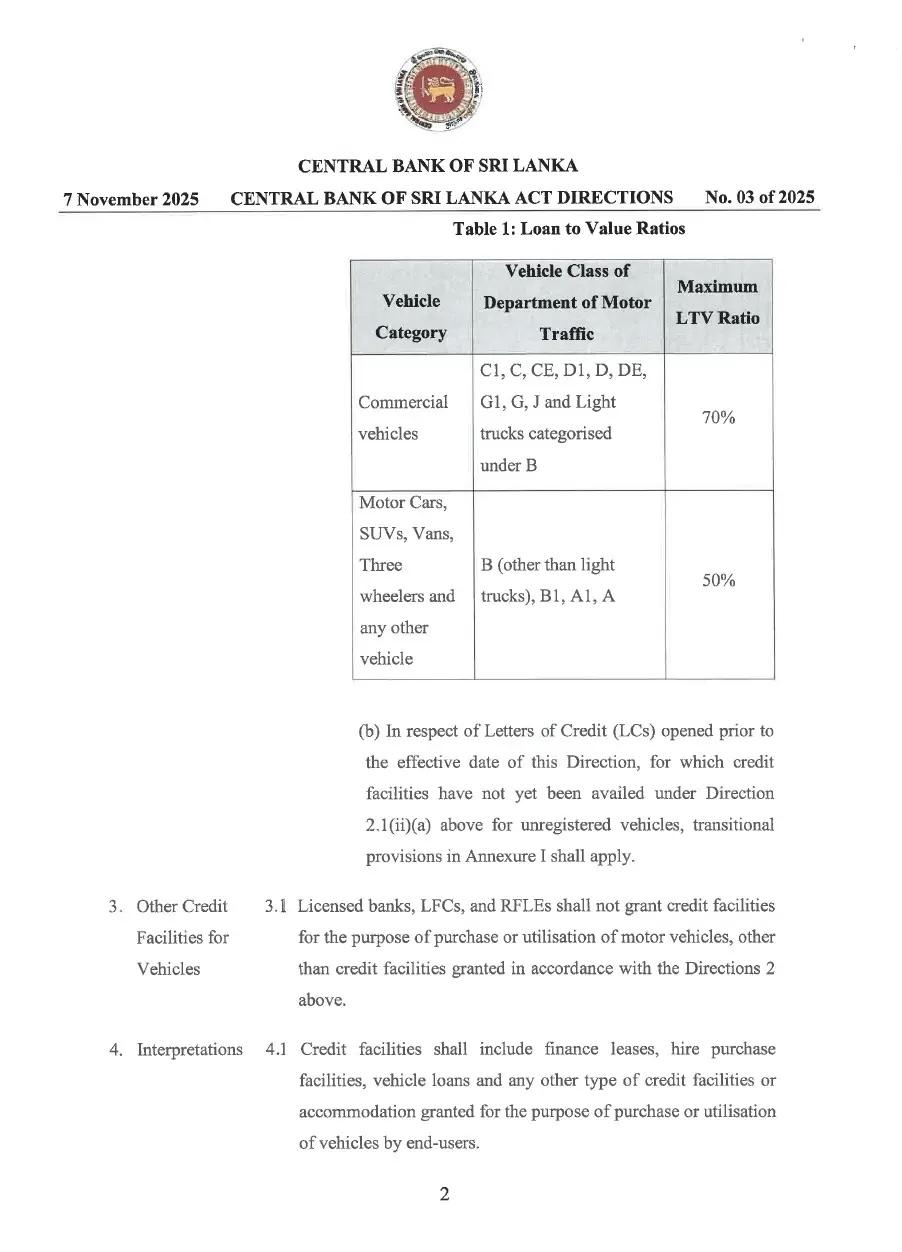

The Central Bank of Sri Lanka has issued a revised directive on vehicle loan-to-value ratios, reducing the maximum leasing percentage for private-use vehicles while slightly easing the limit for commercial fleets. Under the latest regulation, commercial vehicles will now qualify for leasing facilities up to 70% of their value, while all private vehicles have been capped at 50%.

This revision replaces the four-tier structure introduced in July, which allowed 80% leasing for commercial vehicles, 60% for private vehicles, 50% for three-wheelers, and 70% for other categories. The Central Bank has now merged these into just two categories to create what it calls a more “streamlined and risk-aligned credit framework.”

The new rule means cars, vans, three-wheelers and all private-use vehicles will require a minimum 50% down payment from the buyer, significantly tightening affordability at a time when vehicle imports are reopening after years of restrictions. Analysts say the move is aimed at preventing a surge in consumer debt and controlling foreign currency outflow linked to vehicle imports.

Leasing companies are expected to adjust their lending models immediately, while potential vehicle buyers will now face higher upfront costs. The Central Bank has not announced further changes, but industry sources expect tighter credit conditions to continue as part of the broader fiscal discipline policy.